Question: A. Based on the given information below, calculate weighted average of costs of capital (WACC). (13 marks) You have recently been hired by Daina Aircond

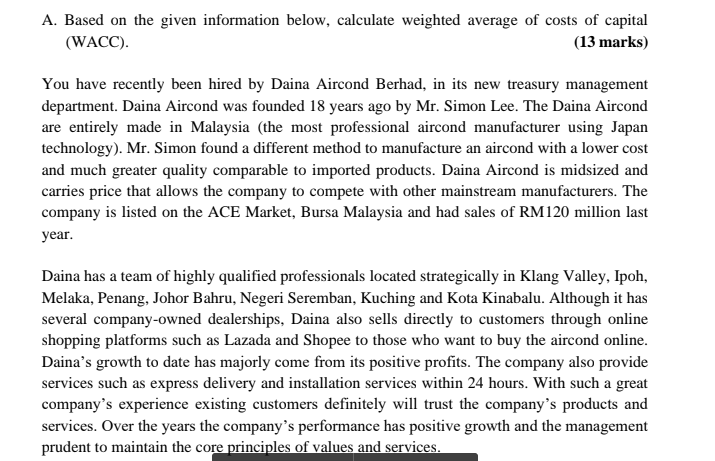

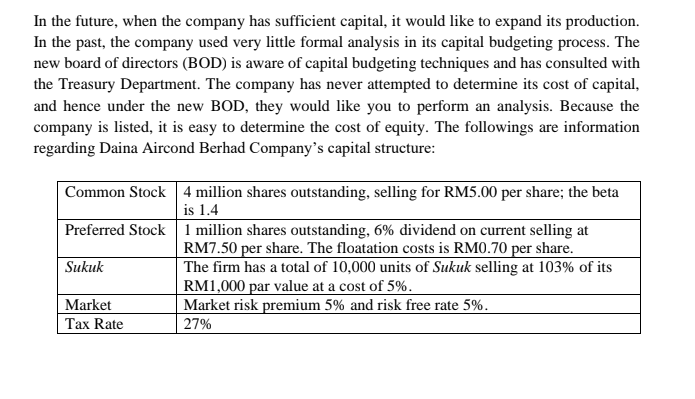

A. Based on the given information below, calculate weighted average of costs of capital (WACC). (13 marks) You have recently been hired by Daina Aircond Berhad, in its new treasury management department. Daina Aircond was founded 18 years ago by Mr. Simon Lee. The Daina Aircond are entirely made in Malaysia (the most professional aircond manufacturer using Japan technology). Mr. Simon found a different method to manufacture an aircond with a lower cost and much greater quality comparable to imported products. Daina Aircond is midsized and carries price that allows the company to compete with other mainstream manufacturers. The company is listed on the ACE Market, Bursa Malaysia and had sales of RM120 million last year. Daina has a team of highly qualified professionals located strategically in Klang Valley, Ipoh, Melaka, Penang, Johor Bahru, Negeri Seremban, Kuching and Kota Kinabalu. Although it has several company-owned dealerships, Daina also sells directly to customers through online shopping platforms such as Lazada and Shopee to those who want to buy the aircond online. Daina's growth to date has majorly come from its positive profits. The company also provide services such as express delivery and installation services within 24 hours. With such a great company's experience existing customers definitely will trust the company's products and services. Over the years the company's performance has positive growth and the management prudent to maintain the core principles of values and services. In the future, when the company has sufficient capital, it would like to expand its production. In the past, the company used very little formal analysis in its capital budgeting process. The new board of directors (BOD) is aware of capital budgeting techniques and has consulted with the Treasury Department. The company has never attempted to determine its cost of capital, and hence under the new BOD, they would like you to perform an analysis. Because the company is listed, it is easy to determine the cost of equity. The followings are information regarding Daina Aircond Berhad Company's capital structure: Common Stock 4 million shares outstanding, selling for RM5.00 per share; the beta is 1.4 Preferred Stock 1 million shares outstanding, 6% dividend on current selling at RM7.50 per share. The floatation costs is RM0.70 per share. Sukuk The firm has a total of 10,000 units of Sukuk selling at 103% of its RM1,000 par value at a cost of 5%. Market Market risk premium 5% and risk free rate 5%. Tax Rate 27% A. Based on the given information below, calculate weighted average of costs of capital (WACC). (13 marks) You have recently been hired by Daina Aircond Berhad, in its new treasury management department. Daina Aircond was founded 18 years ago by Mr. Simon Lee. The Daina Aircond are entirely made in Malaysia (the most professional aircond manufacturer using Japan technology). Mr. Simon found a different method to manufacture an aircond with a lower cost and much greater quality comparable to imported products. Daina Aircond is midsized and carries price that allows the company to compete with other mainstream manufacturers. The company is listed on the ACE Market, Bursa Malaysia and had sales of RM120 million last year. Daina has a team of highly qualified professionals located strategically in Klang Valley, Ipoh, Melaka, Penang, Johor Bahru, Negeri Seremban, Kuching and Kota Kinabalu. Although it has several company-owned dealerships, Daina also sells directly to customers through online shopping platforms such as Lazada and Shopee to those who want to buy the aircond online. Daina's growth to date has majorly come from its positive profits. The company also provide services such as express delivery and installation services within 24 hours. With such a great company's experience existing customers definitely will trust the company's products and services. Over the years the company's performance has positive growth and the management prudent to maintain the core principles of values and services. In the future, when the company has sufficient capital, it would like to expand its production. In the past, the company used very little formal analysis in its capital budgeting process. The new board of directors (BOD) is aware of capital budgeting techniques and has consulted with the Treasury Department. The company has never attempted to determine its cost of capital, and hence under the new BOD, they would like you to perform an analysis. Because the company is listed, it is easy to determine the cost of equity. The followings are information regarding Daina Aircond Berhad Company's capital structure: Common Stock 4 million shares outstanding, selling for RM5.00 per share; the beta is 1.4 Preferred Stock 1 million shares outstanding, 6% dividend on current selling at RM7.50 per share. The floatation costs is RM0.70 per share. Sukuk The firm has a total of 10,000 units of Sukuk selling at 103% of its RM1,000 par value at a cost of 5%. Market Market risk premium 5% and risk free rate 5%. Tax Rate 27%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts