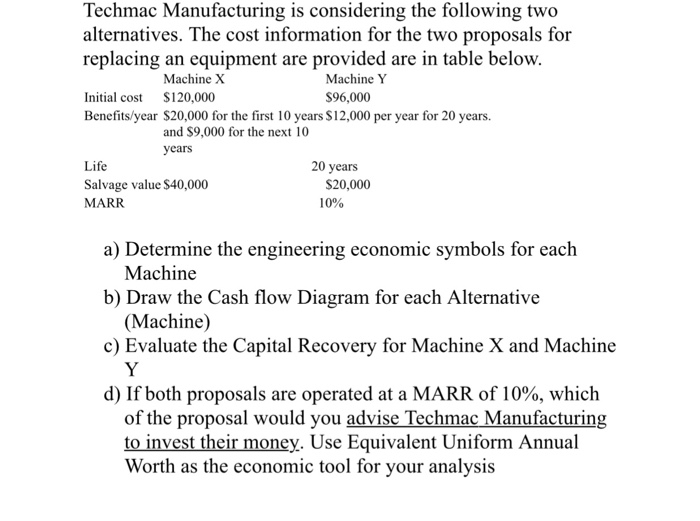

Question: Techmac Manufacturing is considering the following two alternatives. The cost information for the two proposals for replacing an equipment are provided are in table below.

Techmac Manufacturing is considering the following two alternatives. The cost information for the two proposals for replacing an equipment are provided are in table below. Initial cost $120,000 Benefits/year $20,000 for the first 10 years S12,000 per year for 20 years. Machine Y S96,000 Machine X and $9,000 for the next 10 years 20 years Life Salvage value $40,000 MARR S20,000 10% a) Determine the engineering economic symbols for each b) Draw the Cash flow Diagram for each Alternative c) Evaluate the Capital Recovery for Machine X and Machine d) If both proposals are operated at a MARR of 10%, which Machine (Machine) of the proposal would you advise Techmac Manufacturing to invest their money. Use Equivalent Uniform Annual Worth as the economic tool for your analvsis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts