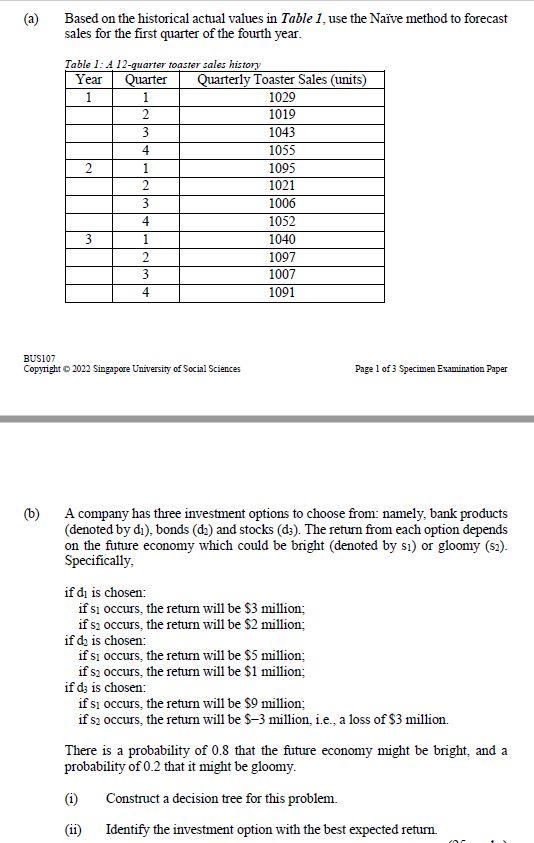

Question: (a) Based on the historical actual values in Table 1, use the Nave method to forecast sales for the first quarter of the fourth year.

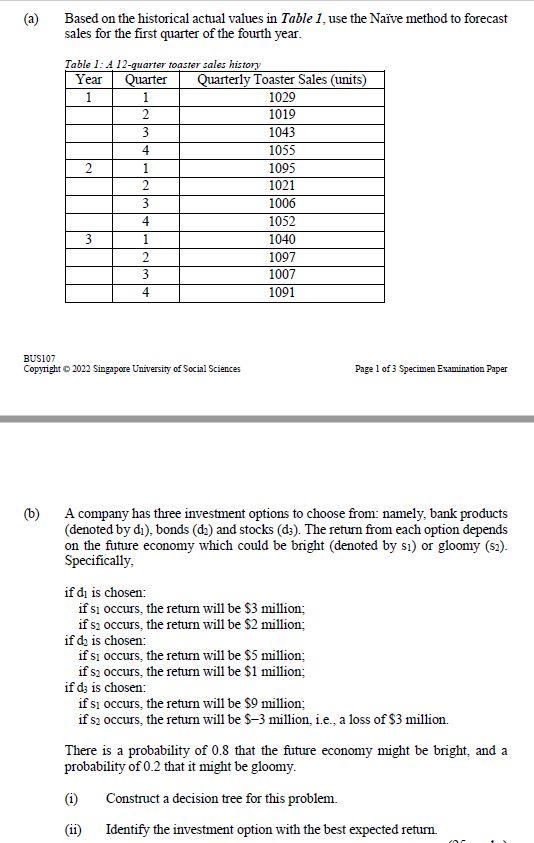

(a) Based on the historical actual values in Table 1, use the Nave method to forecast sales for the first quarter of the fourth year. Table 1: A 12-quarter toaster sales history Year Quarter Quarterly Toaster Sales (units) 1 1 1029 2 1019 3 1043 4 1055 2 1 1095 2 1021 1006 1052 3 1040 1097 1007 4 1091 BUS107 Copyright 2022 Singapore University of Social Sciences Page 1 of 3 Specimen Examination Paper (b) A company has three investment options to choose from: namely, bank products (denoted by di), bonds (da) and stocks (d3). The return from each option depends on the future economy which could be bright (denoted by s) or gloomy (s2). Specifically, if di is chosen: if si occurs, the return will be $3 million; if s2 occurs, the return will be $2 million; if d is chosen: if si occurs, the return will be $5 million; if s2 occurs, the return will be $1 million; if d; is chosen: if si occurs, the return will be $9 million; if s2 occurs, the return will be $-3 million, i.e., a loss of $3 million. There is a probability of 0.8 that the future economy might be bright, and a probability of 0.2 that it might be gloomy. (1) Construct a decision tree for this problem. (ii) Identify the investment option with the best expected return. 3 4 1 2 3 (a) Based on the historical actual values in Table 1, use the Nave method to forecast sales for the first quarter of the fourth year. Table 1: A 12-quarter toaster sales history Year Quarter Quarterly Toaster Sales (units) 1 1 1029 2 1019 3 1043 4 1055 2 1 1095 2 1021 1006 1052 3 1040 1097 1007 4 1091 BUS107 Copyright 2022 Singapore University of Social Sciences Page 1 of 3 Specimen Examination Paper (b) A company has three investment options to choose from: namely, bank products (denoted by di), bonds (da) and stocks (d3). The return from each option depends on the future economy which could be bright (denoted by s) or gloomy (s2). Specifically, if di is chosen: if si occurs, the return will be $3 million; if s2 occurs, the return will be $2 million; if d is chosen: if si occurs, the return will be $5 million; if s2 occurs, the return will be $1 million; if d; is chosen: if si occurs, the return will be $9 million; if s2 occurs, the return will be $-3 million, i.e., a loss of $3 million. There is a probability of 0.8 that the future economy might be bright, and a probability of 0.2 that it might be gloomy. (1) Construct a decision tree for this problem. (ii) Identify the investment option with the best expected return. 3 4 1 2 3