Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A borrower can obtain an 80 percent loan with an 9 percent interest rate and monthly payments. The loan is to be fully amortized

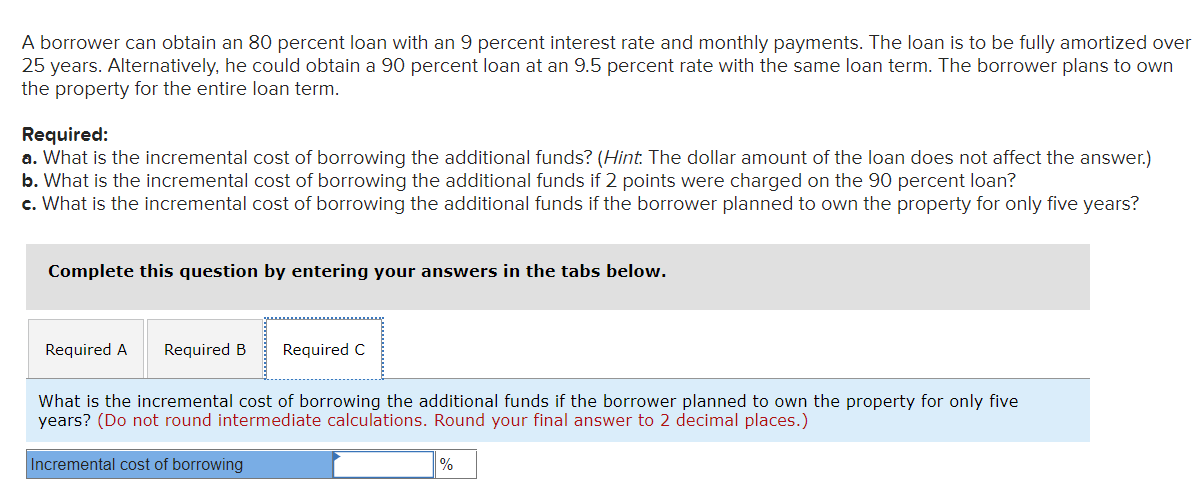

A borrower can obtain an 80 percent loan with an 9 percent interest rate and monthly payments. The loan is to be fully amortized over 25 years. Alternatively, he could obtain a 90 percent loan at an 9.5 percent rate with the same loan term. The borrower plans to own the property for the entire loan term. Required: a. What is the incremental cost of borrowing the additional funds? (Hint. The dollar amount of the loan does not affect the answer.) b. What is the incremental cost of borrowing the additional funds if 2 points were charged on the 90 percent loan? c. What is the incremental cost of borrowing the additional funds if the borrower planned to own the property for only five years? Complete this question by entering your answers in the tabs below. Required A Required B Required C What is the incremental cost of borrowing the additional funds if the borrower planned to own the property for only five years? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Incremental cost of borrowing %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To calculate the cost of borrowing the additional funds we need to compare ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663de70e57629_961196.pdf

180 KBs PDF File

663de70e57629_961196.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started