Question: a) Calculate expected excess returns for stock A. b) Calculate expected excess returns for stock B. c) Calculate expected alpha values for stock A. d)

a) Calculate expected excess returns for stock A.

b) Calculate expected excess returns for stock B.

c) Calculate expected alpha values for stock A.

d) Calculate expected alpha values for stock B.

e) Calculate expected residual variances for stock A.

f) Calculate expected residual variances for stock B.

g) Suppose that the portfolio manager follows the Treynor-Black model, and constructs an active portfolio (p) that consists of the above two stocks. The alpha of the active portfolio (p) is -18%, and its residual standard deviation is 150%.

Instruction: enter your response as a decimal number rounded to four decimal places.

What is the Sharpe ratio for the optimal portfolio (consisting of the passive equity portfolio and the active portfolio (p))?

h) Suppose that the portfolio manager follows the Treynor-Black model, and constructs an active portfolio (p) that consists of the above two stocks. The alpha of the active portfolio (p) is -18%, and its residual standard deviation is 150%.

Instruction: enter your response as a decimal number rounded to four decimal places.

Whats the M2 of the optimal portfolio?

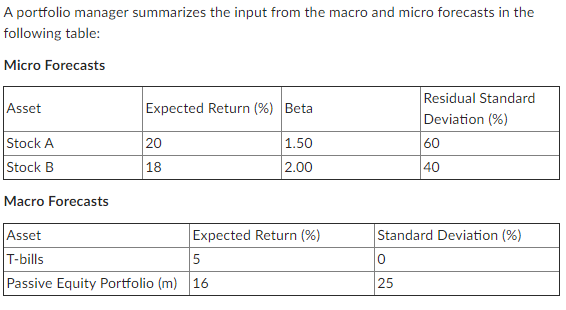

A portfolio manager summarizes the input from the macro and micro forecasts in the following table: Micro Forecasts Asset Expected Return (%) Beta Residual Standard Deviation (%) 60 40 20 Stock A Stock B 1.50 2.00 18 Macro Forecasts Standard Deviation (%) Asset Expected Return (%) T-bills 5 Passive Equity Portfolio (m) 16 0 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts