Question: a. Calculate expected return and standard deviation for these FOUR (4) stocks. (8 marks) b. Plot the SML either on the graph paper or in

a. Calculate expected return and standard deviation for these FOUR (4) stocks.

(8 marks)

b. Plot the SML either on the graph paper or in Ms Words. Find the slope and the risk

premium from the graph and calculation.

(9 marks)

c. Interpret the alpha for each stock and indicate in the graph. (4 marks)

d. Criticise the findings for all the four stocks according to the Security Market Line

(SML) dividend discounted model (DDM) and from (a).

(6 marks)

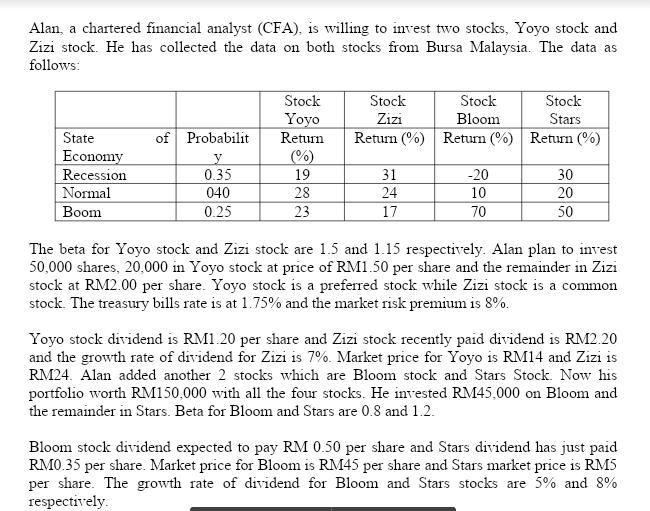

Alan, a chartered financial analyst (CFA), is willing to invest two stocks, Yoyo stock and Zizi stock. He has collected the data on both stocks from Bursa Malaysia. The data as follows: Stock Stock Stock Stock Yoyo Zizi Bloom Stars State of Probabilit Return Return (%) Return (%) Return (%) Economy y (%) Recession 0.35 19 31 -20 30 Normal 040 28 24 10 20 Boom 0.25 23 17 70 50 The beta for Yoyo stock and Zizi stock are 1.5 and 1.15 respectively. Alan plan to invest 50,000 shares, 20,000 in Yoyo stock at price of RM1.50 per share and the remainder in Zizi stock at RM2.00 per share. Yoyo stock is a preferred stock while Zizi stock is a common stock. The treasury bills rate is at 1.75% and the market risk premium is 8%. Yoyo stock dividend is RM1.20 per share and Zizi stock recently paid dividend is RM2.20 and the growth rate of dividend for Zizi is 7%. Market price for Yoyo is RM14 and Zizi is RM24. Alan added another 2 stocks which are Bloom stock and Stars Stock. Now his portfolio worth RM150,000 with all the four stocks. He invested RM45,000 on Bloom and the remainder in Stars. Beta for Bloom and Stars are 0.8 and 1.2. Bloom stock dividend expected to pay RM 0.50 per share and Stars dividend has just paid RM0.35 per share. Market price for Bloom is RM45 per share and Stars market price is RM5 per share. The growth rate of dividend for Bloom and Stars stocks are 5% and 8% respectively.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts