Question: A) Calculate the payback period for each project. Using the payback period rule and assuming the projects are independent, what project(s) would you recommend to

A) Calculate the payback period for each project. Using the payback period rule and assuming the projects are independent, what project(s) would you recommend to Wise Inc.? What if the projects are mutually exclusive?

A) Calculate the payback period for each project. Using the payback period rule and assuming the projects are independent, what project(s) would you recommend to Wise Inc.? What if the projects are mutually exclusive?

B) Calculate the IRR for each project. Using the IRR rule and assuming the projects are independent, what project(s) would you recommend to Wise Inc.? What if the projects are mutually exclusive?

C) Calculate the NPV for each project. Using the NPV rule and assuming the projects are independent, what project(s) would you recommend to Wise Inc.? What if the projects are mutually exclusive?

DONE OUT ON PAPER

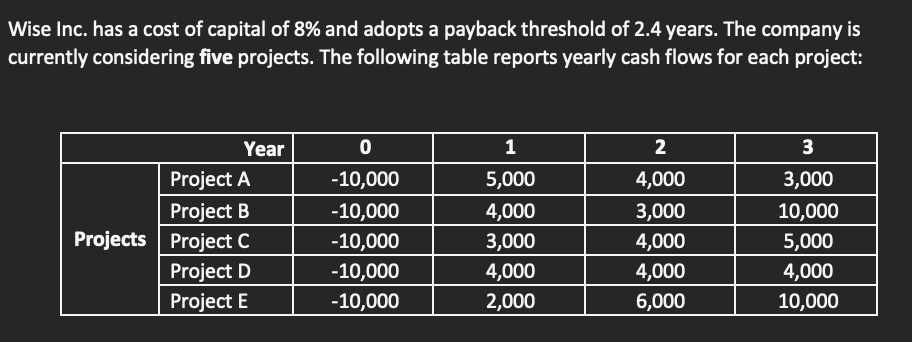

Wise Inc. has a cost of capital of 8% and adopts a payback threshold of 2.4 years. The company is currently considering five projects. The following table reports yearly cash flows for each project: 0 1 3 Year Project A Project B Projects Project C Project D Project E -10,000 -10,000 -10,000 -10,000 -10,000 5,000 4,000 3,000 4,000 2,000 2 4,000 3,000 4,000 4,000 6,000 3,000 10,000 5,000 4,000 10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts