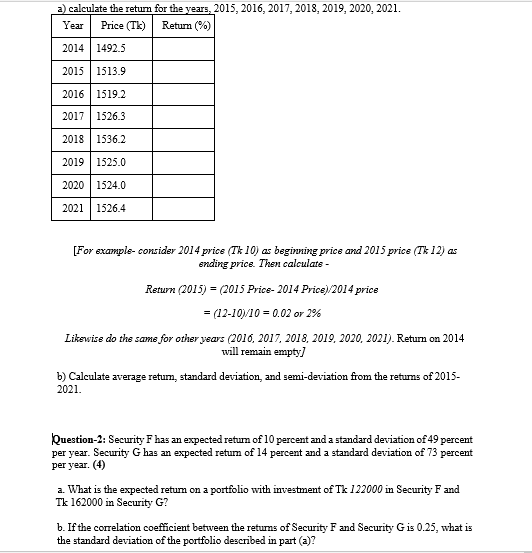

Question: a) calculate the return for the years, 2015, 2016, 2017, 2018, 2019, 2020, 2021. Year Price (TK) Return (%) 2014 1492.5 2015 1513.9 2016 1519.2

a) calculate the return for the years, 2015, 2016, 2017, 2018, 2019, 2020, 2021. Year Price (TK) Return (%) 2014 1492.5 2015 1513.9 2016 1519.2 2017 1526.3 2018 1536.2 2019 1525.0 2020 | 1524.0 2021 1526.4 [For example-consider 2014 price (TX 10) as beginning price and 2015 price (Tk12) as ending price. Then calculate - Return (2015) = (2015 Price-2014 Prics)/2014 price = (12-10)/10 = 0.02 or 3% Likewise do the same for other years (2010, 2017, 2018, 2019, 2020 2021). Return on 2014 will remain empty] b) Calculate average retum, standard deviation, and semi-deviation from the retums of 2015- 2021. Question-2: Security F has an expected return of 10 percent and a standard deviation of 49 percent per year. Security G has an expected retum of 14 percent and a standard deviation of 73 percent per year. (4) a. What is the expected retum on a portfolio with investment of Tk 122000 in Security F and Tk 162000 in Security G? b. If the correlation coefficient between the retums of Security F and Security G is 0.25, what is the standard deviation of the portfolio described in part (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts