Question: A company has a choice between two mutually exclusive projects, A and B. Project A lasts for three years and Project B lasts for five

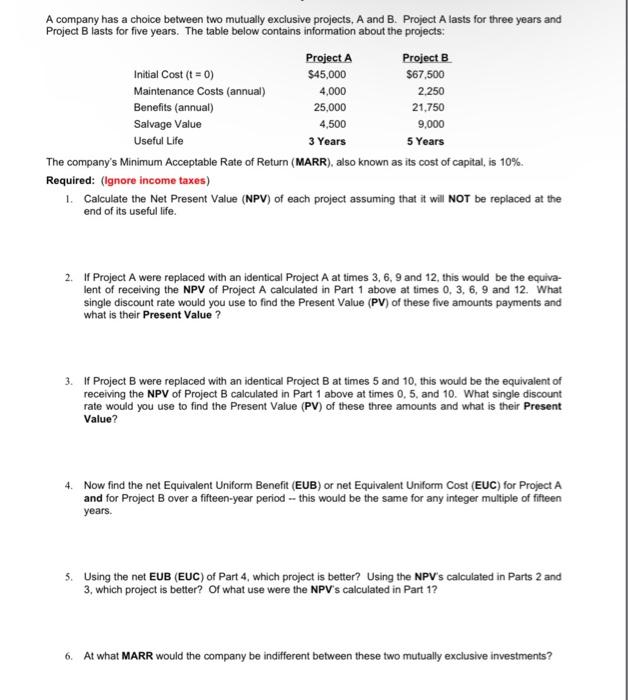

A company has a choice between two mutually exclusive projects, A and B. Project A lasts for three years and Project B lasts for five years. The table below contains information about the projects: The company's Minimum Acceptable Rate of Return (MARR), also known as its cost of capital, is 10%. Required: (Ignore income taxes) 1. Calculate the Net Present Value (NPV) of each project assuming that it will NOT be replaced at the end of its useful life. 2. If Project A were replaced with an identical Project A at times 3,6,9 and 12 , this would be the equivalent of receiving the NPV of Project A calculated in Part 1 above at times 0,3,6,9 and 12. What single discount rate would you use to find the Present Value (PV) of these five amounts payments and what is their Present Value? 3. If Project B were replaced with an identical Project B at times 5 and 10 , this would be the equivalent of receiving the NPV of Project B calculated in Part 1 above at times 0,5 , and 10 . What single discount rate would you use to find the Present Value (PV) of these three amounts and what is their Present Value? 4. Now find the net Equivalent Uniform Benefit (EUB) or net Equivalent Uniform Cost (EUC) for Project A and for Project B over a fifteen-year period - this would be the same for any integer multiple of fifteen years. 5. Using the net EUB (EUC) of Part 4, which project is better? Using the NPV's calculated in Parts 2 and 3, which project is better? Of what use were the NPV s calculated in Part 1 ? 6. At what MARR would the company be indifferent between these two mutually exclusive investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts