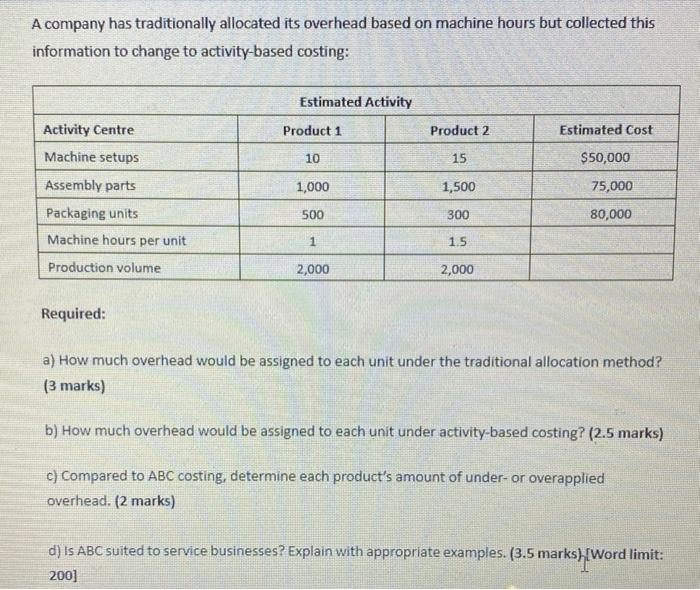

Question: A company has traditionally allocated its overhead based on machine hours but collected this information to change to activity-based costing: Estimated Activity Activity Centre Product

A company has traditionally allocated its overhead based on machine hours but collected this information to change to activity-based costing: Estimated Activity Activity Centre Product 1 Product 2 Estimated Cost Machine setups 10 15 $50,000 Assembly parts 1,000 1,500 75,000 500 300 80,000 Packaging units Machine hours per unit 1 1.5 Production volume 2,000 2,000 Required: a) How much overhead would be assigned to each unit under the traditional allocation method? (3 marks) b) How much overhead would be assigned to each unit under activity-based costing? (2.5 marks) c) Compared to ABC costing, determine each product's amount of under-or overapplied overhead. (2 marks) d) Is ABC suited to service businesses? Explain with appropriate examples. (3.5 marks) [Word limit: 200]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts