Question: A company is considering a project which will initially cost $130000. It believes this project will generate a stream of cash flows of $29000 per

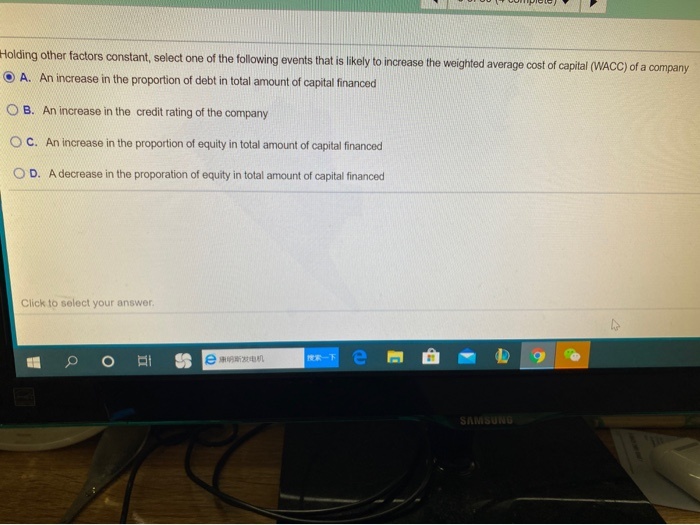

Holding other factors constant, select one of the following events that is likely to increase the weighted average cost of capital (WACC) of a company O A. An increase in the proportion of debt in total amount of capital financed OB. An increase in the credit rating of the company OC. An increase in the proportion of equity in total amount of capital financed OD. A decrease in the proporation of equity in total amount of capital financed Click to select your answer. - 9 201 Sewowane

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts