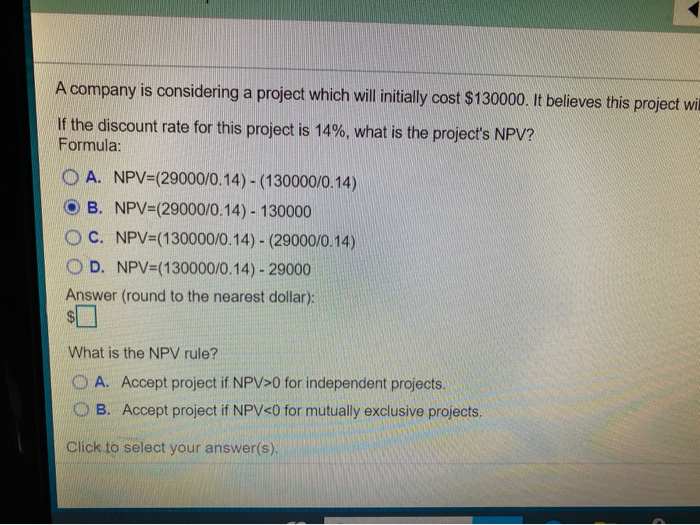

Question: A company is considering a project which will initially cost $130000. It believes this project will generate a stream of cash flows of $29000 per

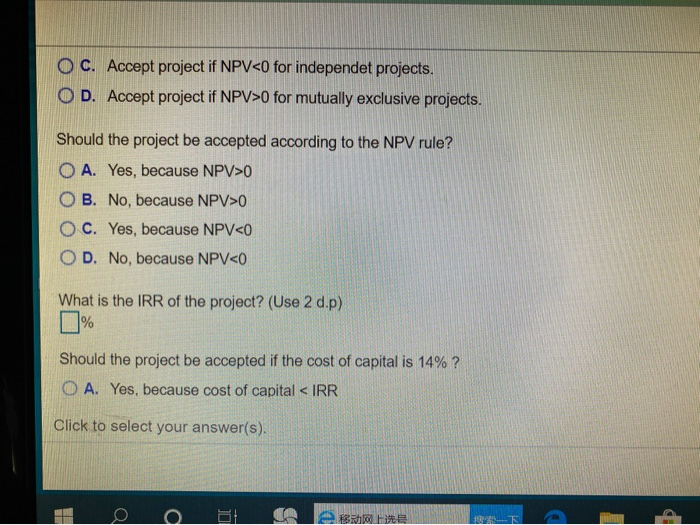

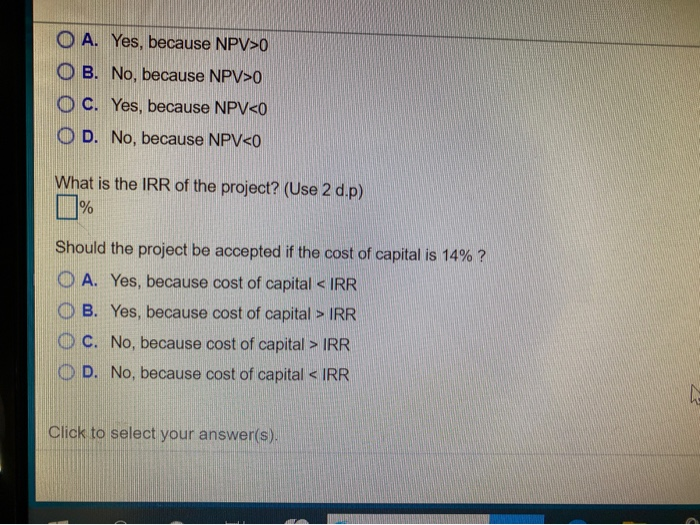

A company is considering a project which will initially cost $130000. It believes this project wil If the discount rate for this project is 14%, what is the project's NPV? Formula: O A. NPV=(29000/0.14) - (130000/0.14) OB. NPV=(29000/0.14) - 130000 O C. NPV=(130000/0.14) - (29000/0.14) OD. NPV=(130000/0.14) - 29000 Answer (round to the nearest dollar): What is the NPV rule? O A. Accept project if NPV>0 for independent projects, OB. Accept project if NPV0 for mutually exclusive projects. Should the project be accepted according to the NPV rule? O A. Yes, because NPV>0 OB. No, because NPV>0 OC. Yes, because NPV0 O B. No, because NPV>0 O c. Yes, because NPV IRR O C. No, because cost of capital > IRR OD. No, because cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts