Question: A company is considering a project which will initially cost $95000. It believes this project will generate a stream of cash flows of $31000 per

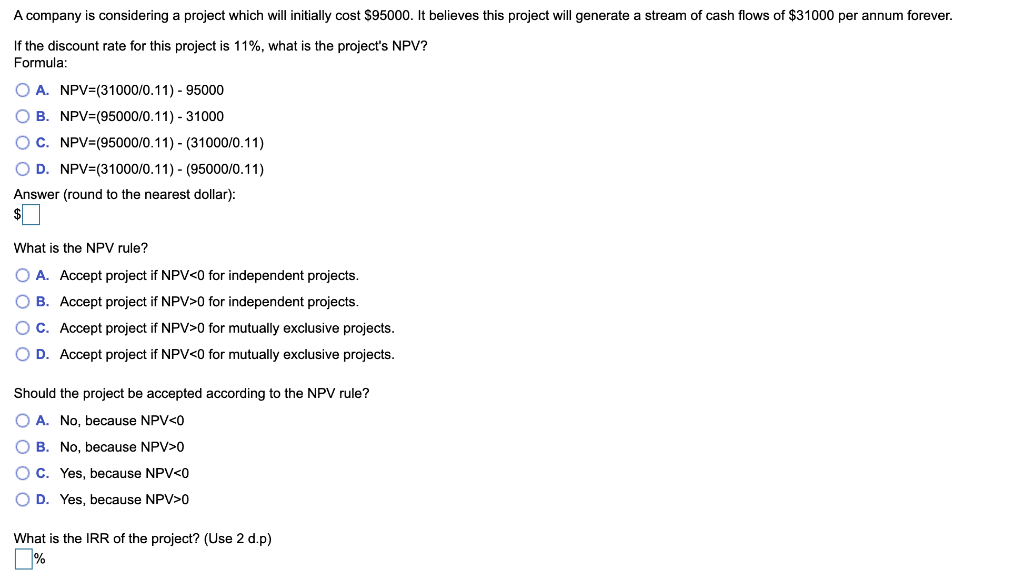

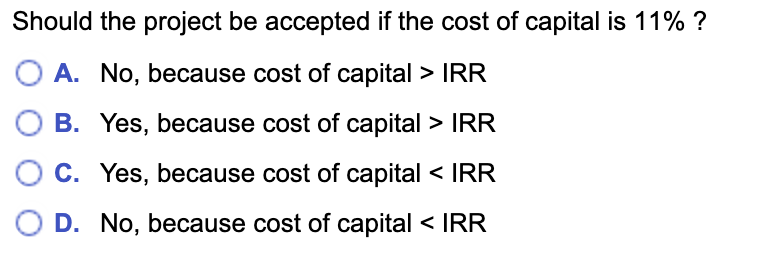

A company is considering a project which will initially cost $95000. It believes this project will generate a stream of cash flows of $31000 per annum forever. If the discount rate for this project is 11%, what is the project's NPV? Formula: O A. NPV=(31000/0.11) - 95000 OB. NPV=(95000/0.11) - 31000 O C. NPV=(95000/0.11) - (31000/0.11) OD. NPV=(31000/0.11) - (95000/0.11) Answer (round to the nearest dollar): $ What is the NPV rule? O A. Accept project if NPV0 for independent projects. OC. Accept project if NPV>0 for mutually exclusive projects. OD. Accept project if NPVO OC. Yes, because NPV What is the IRR of the project? (Use 2 d.p) % Should the project be accepted if the cost of capital is 11% ? O A. No, because cost of capital > IRR B. Yes, because cost of capital > IRR C. Yes, because cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts