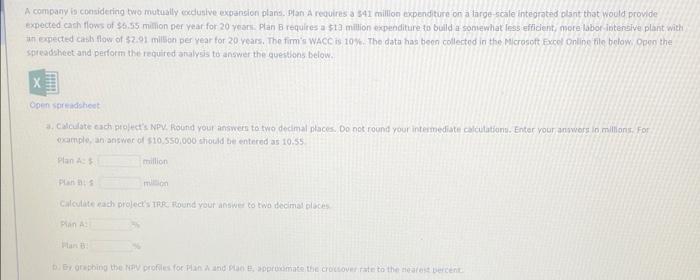

Question: A company is considering two mutually coedusive expansion plans Plan Arequires a 341 million expenditure on a large-scale integrated plant that would provide expected cash

A company is considering two mutually coedusive expansion plans Plan Arequires a 341 million expenditure on a large-scale integrated plant that would provide expected cash flows of $6,55 million per year for 20 years Plan B requires a la million expenditure to build a son what less effident more labor intensive plant with unexpected the flow of 52.01 million per year for 20 years. The firm's WACC is 10%. The data has been collected in the Microsoft Excel Online ile below. Open the spreadsheet and perform the required analysis to answer the questions below Open spreadsheet calculate cach project's NPV. Round your answer to two decimal places. Do not round your intermediate calculations. Enter your answers in millions. For example, an answer of $10.550.000 should be entered as 10:55 million pun Calculate each project's T Round your answer to two decimal places Plan A Devothing the NEV profiles for Pin and promote the crocoverate to the nearest bercent b. By graphing the NPV profiles for Plan A and Plan B, approximate the crossover rate to the nearest percent c. Calculate the croutover rate where the two projects' NPVs are equal. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts