Question: A Company is considering two mutually exclusive projects. Project K will require an initial cash investment in machinery of 2,68,000. It is anticipated that

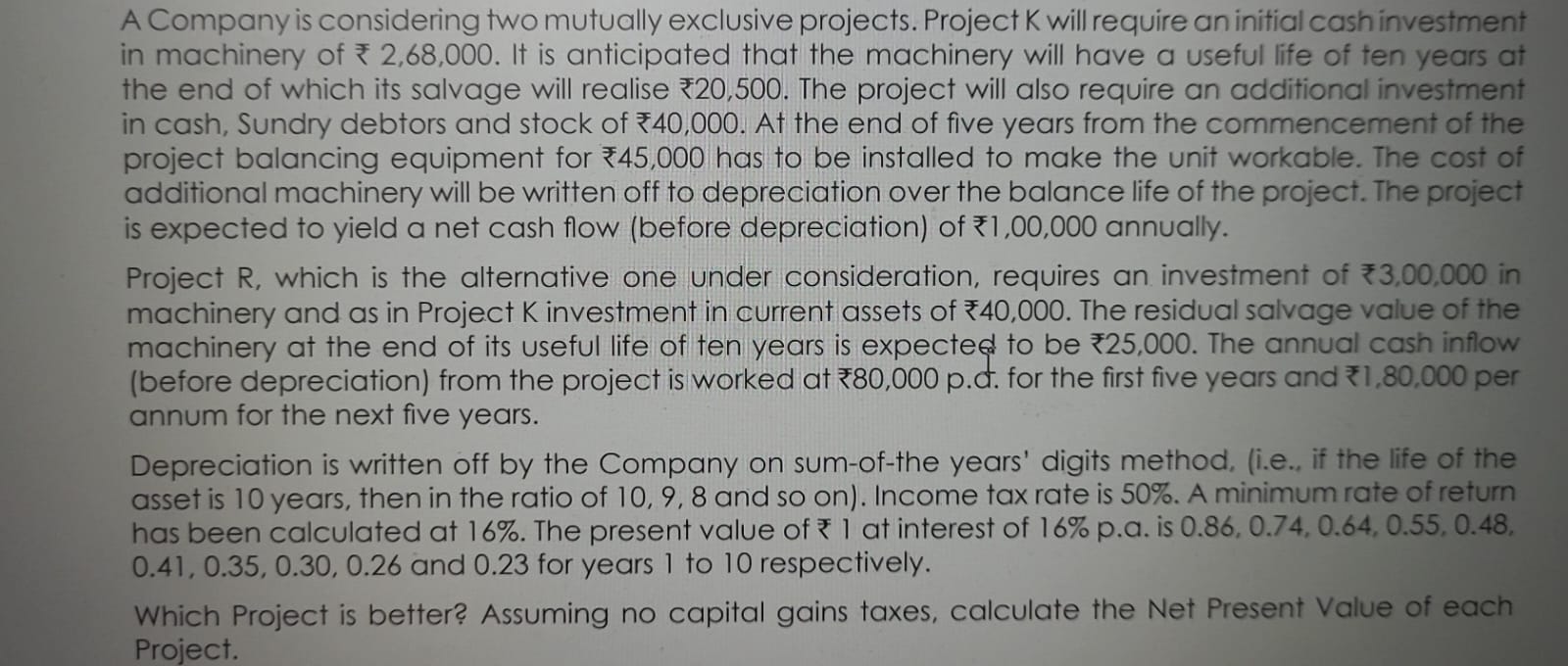

A Company is considering two mutually exclusive projects. Project K will require an initial cash investment in machinery of 2,68,000. It is anticipated that the machinery will have a useful life of ten years at the end of which its salvage will realise 20,500. The project will also require an additional investment in cash, Sundry debtors and stock of 40,000. At the end of five years from the commencement of the project balancing equipment for 45,000 has to be installed to make the unit workable. The cost of additional machinery will be written off to depreciation over the balance life of the project. The project is expected to yield a net cash flow (before depreciation) of 1,00,000 annually. Project R, which is the alternative one under consideration, requires an investment of 3,00,000 in machinery and as in Project K investment in current assets of 40,000. The residual salvage value of the machinery at the end of its useful life of ten years is expected to be *25,000. The annual cash inflow (before depreciation) from the project is worked at 80,000 p.d. for the first five years and 1,80,000 per annum for the next five years. Depreciation is written off by the Company on sum-of-the years' digits method, (i.e., if the life of the asset is 10 years, then in the ratio of 10, 9, 8 and so on). Income tax rate is 50%. A minimum rate of return has been calculated at 16%. The present value of 1 at interest of 16% p.a. is 0.86, 0.74, 0.64, 0.55, 0.48. 0.41, 0.35, 0.30, 0.26 and 0.23 for years 1 to 10 respectively. Which Project is better? Assuming no capital gains taxes, calculate the Net Present Value of each Project.

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

SOLUTION To determine which project is better we need to calculate the Net Present Value NPV of each ... View full answer

Get step-by-step solutions from verified subject matter experts