Question: A company is evaluating two mutually exclusive projects: Project A has an initial investment of $ 4 , 0 0 0 , 0 0 0

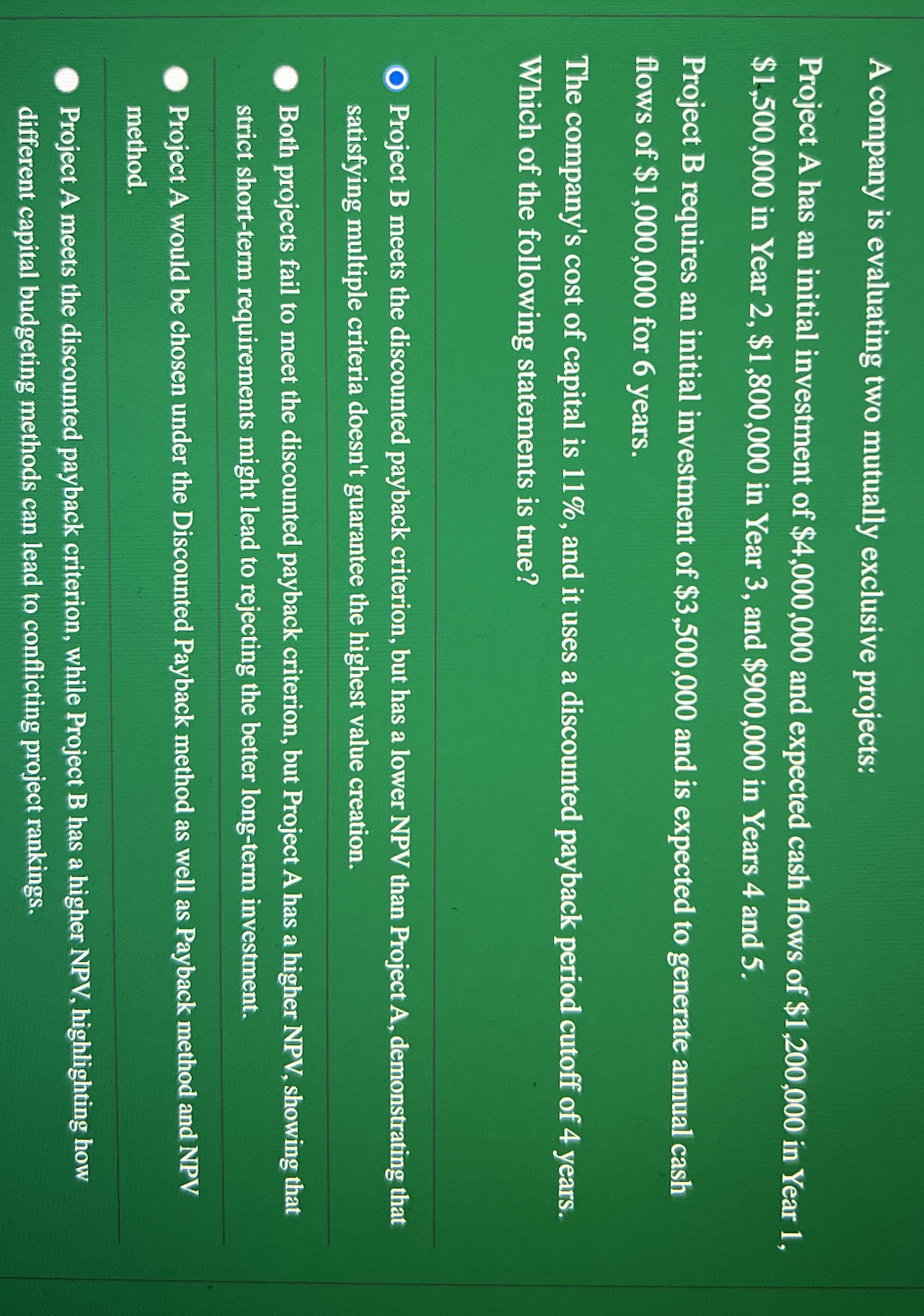

A company is evaluating two mutually exclusive projects:

Project A has an initial investment of $ and expected cash flows of $ in Year

$ in Year $ in Year and $ in Years and

Project B requires an initial investment of $ and is expected to generate annual cash

flows of $ for years.

The company's cost of capital is and it uses a discounted payback period cutoff of years.

Which of the following statements is true?

Project B meets the discounted payback criterion, but has a lower NPV than Project A demonstrating that

satisfying multiple criteria doesn't guarantee the highest value creation.

Both projects fail to meet the discounted payback criterion, but Project A has a higher NPV showing that

strict shortterm requirements might lead to rejecting the better longterm investment.

Project A would be chosen under the Discounted Payback method as well as Payback method and NPV

method.

Project A meets the discounted payback criterion, while Project B has a higher NPV highlighting how

different capital budgeting methods can lead to conflicting project rankings.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock