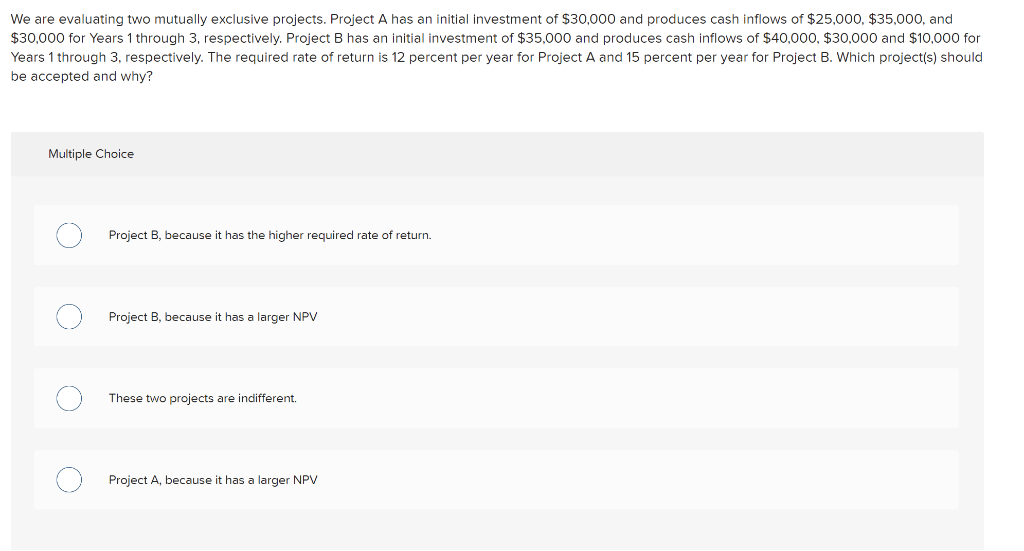

Question: We are evaluating two mutually exclusive projects. Project A has an initial investment of $30,000 and produces cash inflows of $25,000. $35,000, and $30,000 for

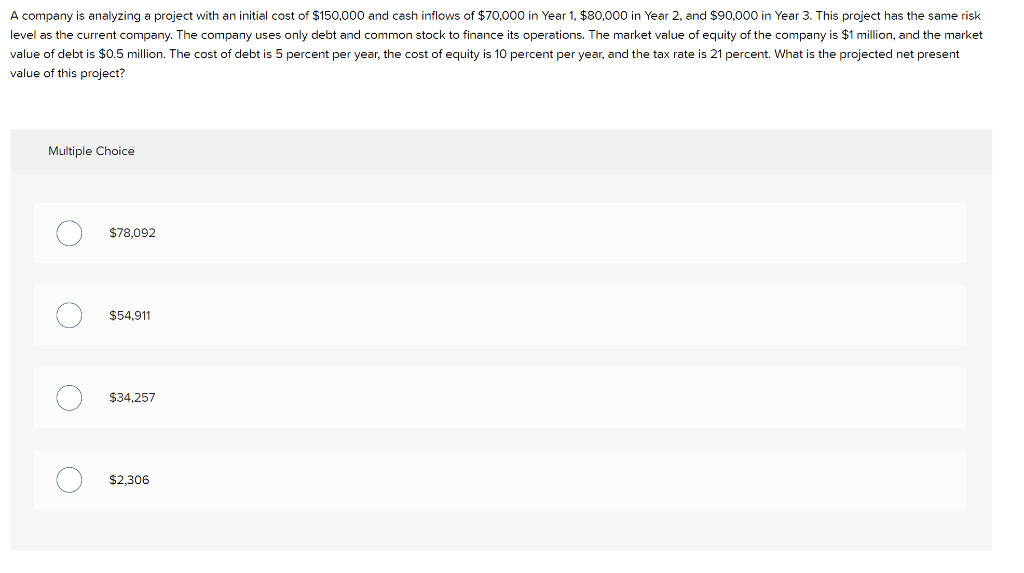

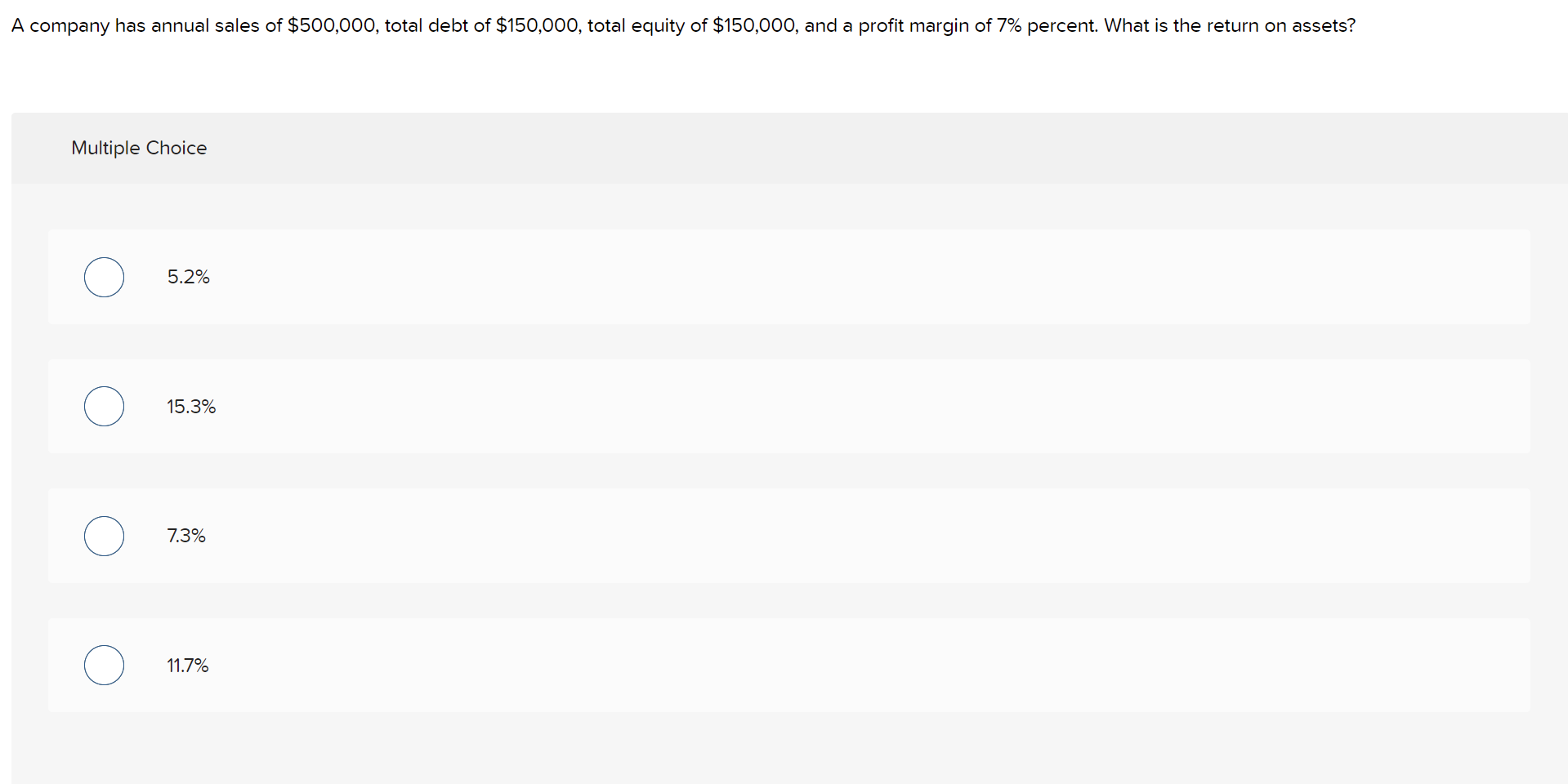

We are evaluating two mutually exclusive projects. Project A has an initial investment of $30,000 and produces cash inflows of $25,000. $35,000, and $30,000 for Years 1 through 3, respectively. Project B has an initial investment of $35,000 and produces cash inflows of $40,000, $30,000 and $10,000 for Years 1 through 3, respectively. The required rate of return is 12 percent per year for Project A and 15 percent per year for Project B. Which project(s) should be accepted and why? Multiple Choice O Project B, because it has the higher required rate of return. Project B, because it has a larger NPV These two projects are indifferent. O () Project A, because it has a larger NPV A company is analyzing a project with an initial cost of $150,000 and cash inflows of $70,000 in Year 1, $80,000 in Year 2, and $90,000 in Year 3. This project has the same risk level as the current company. The company uses only debt and common stock to finance its operations. The market value of equity of the company is $1 million, and the market value of debt is $0.5 million. The cost of debt is 5 percent per year, the cost of equity is 10 percent per year, and the tax rate is 21 percent. What is the projected net present value of this project? Multiple Choice $78,092 O $54.911 O O $34,257 O $2,306 A company has annual sales of $500,000, total debt of $150,000, total equity of $150,000, and a profit margin of 7% percent. What is the return on assets? Multiple Choice 5.2% 15.3% 7.3% 11.7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts