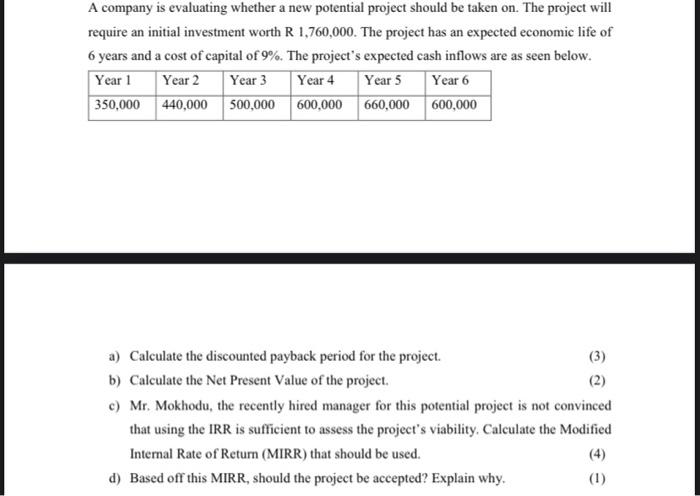

Question: A company is evaluating whether a new potential project should be taken on. The project will require an initial investment worth R1,760,000. The project has

A company is evaluating whether a new potential project should be taken on. The project will require an initial investment worth R1,760,000. The project has an expected economic life of 6 years and a cost of capital of 9%. The project's expected cash inflows are as seen below. a) Calculate the discounted payback period for the project. b) Calculate the Net Present Value of the project. c) Mr. Mokhodu, the recently hired manager for this potential project is not convinced that using the IRR is sufficient to assess the project's viability. Calculate the Modified Internal Rate of Return (MIRR) that should be used. d) Based off this MIRR, should the project be accepted? Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts