Question: a) Compare the equations of the efficient frontier with riskless lending and borrowing and short sales for a combination of a domestic equity portfolio

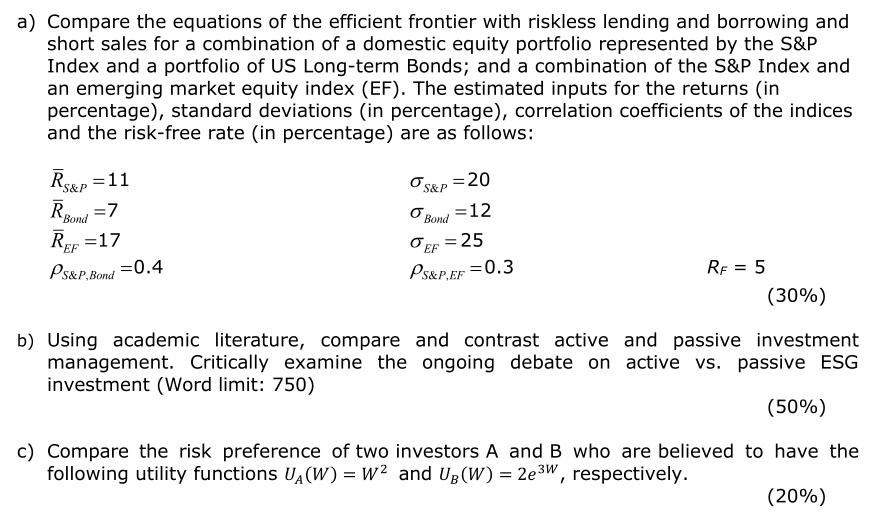

a) Compare the equations of the efficient frontier with riskless lending and borrowing and short sales for a combination of a domestic equity portfolio represented by the S&P Index and a portfolio of US Long-term Bonds; and a combination of the S&P Index and an emerging market equity index (EF). The estimated inputs for the returns (in percentage), standard deviations (in percentage), correlation coefficients of the indices and the risk-free rate (in percentage) are as follows: RS&P=11 =7 R Bond REF=17 Ps&P,Bond = 0.4 O S&P = 20 OB = 12 Bond OF = 25 EF PS&P.EF = 0.3 RF = 5 (30%) b) Using academic literature, compare and contrast active and passive investment management. Critically examine the ongoing debate on active vs. passive ESG investment (Word limit: 750) (50%) c) Compare the risk preference of two investors A and B who are believed to have the following utility functions UA(W) = W and UB (W) = 2eW, respectively. 3W (20%)

Step by Step Solution

There are 3 Steps involved in it

a The equations of the efficient frontier with riskless lending and borrowing and short sales allow us to construct portfolios that combine risky assets and riskfree assets or engage in short selling ... View full answer

Get step-by-step solutions from verified subject matter experts