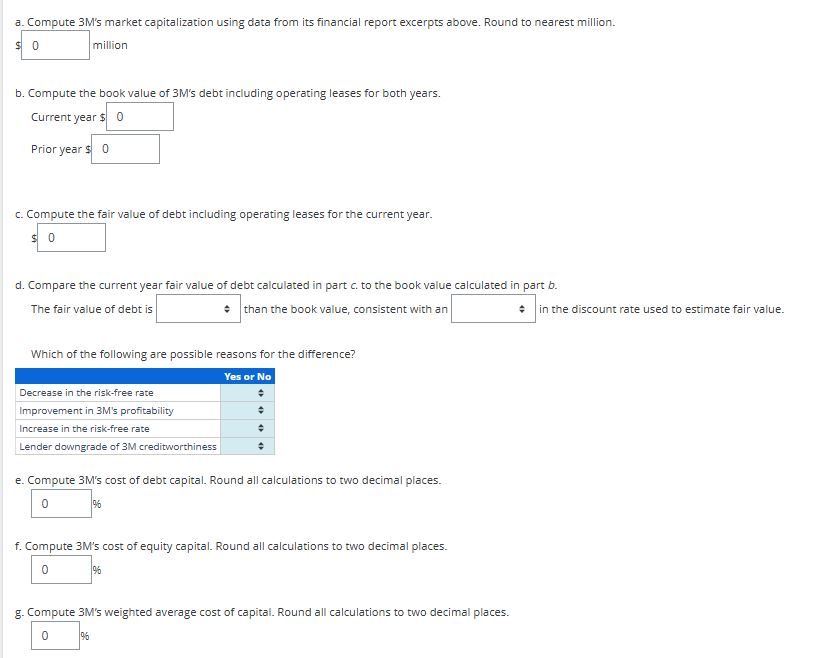

Question: a . Compute 3 M ' s market capitalization using data from its financial report excerpts above. Round to nearest million. million b . Compute

a Compute M s market capitalization using data from its financial report excerpts above. Round to nearest million. million

b Compute the book value of M s debt including operating leases for both years.

Current year $

Prior year $

c Compute the fair value of debt including operating leases for the current year.

d Compare the current year fair value of debt calculated in part c to the book value calculated in part b

The fair value of debt is than the book value, consistent with an in the discount rate used to estimate fair value.

Which of the following are possible reasons for the difference?

e Compute Ms cost of debt capital. Round all calculations to two decimal places.

f Compute Ms cost of equity capital. Round all calculations to two decimal places.

g Compute M s weighted average cost of capital. Round all calculations to two decimal places. The following information is from M Company.

begintabularccc

hline begintabularl

Liabilities and Equity

$ millions

endtabular & Current year & Prior year

hline Shortterm borrowings and current portion of longterm debt & $ & $

hline Accounts payable & &

hline Accrued payroll & &

hline Accrued income taxes & &

hline Operating lease liabilities current & &

hline Other current liabilities & &

hline Total current liabilities & &

hline Longterm debt & &

hline Pension and postretirement benefits & &

hline Operating lease liabilities & &

hline Other liabilities & &

hline Total liabilities & &

hline Common stock shares issued & &

hline Additional paidin capital & &

hline Retained earnings & &

hline Treasury stock, at cost shares & &

hline Accumulated other comprehensive income loss & &

hline Total M Company shareholders' equity & &

hline Noncontrolling interest & &

hline Total equity & &

hline Total liabilities and equity & $ & $

hline

endtabular

Notes to Ms K disclose the following information for the current year:

begintabularlr

hline multicolumncbegintabularc

Disclosures

$ millions

endtabular

hline Interest expense, from the income statement & $

hline Weighted average discount rate on operating leases &

hline Tax rate &

hline Fair value of debr excluding operating leases & $

hline

endtabular

The following additional information is from Finance.yahoo at the current yearend.

begintabularlr

hline Additional Information &

hline Stock price & $

hline Market beta &

hline Riskfree rate &

hline Market risk premium &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock