Question: a. Compute: Expected value, standard deviation, and coefficient of variation for cash flows of each project. b. Calculate: Risk-adjusted NPV for each project using cost

a. Compute: Expected value, standard deviation, and coefficient of variation for cash flows of each project.

b. Calculate: Risk-adjusted NPV for each project using cost of capital 15% for riskier projects, and cost of capital 12% for less risky projects. Which project is more profitable with using the NPV criteria?

c. Calculate: PI for each project, and rank the projects according to the criteria

d. Calculate: IRR for each project, and rank the projects according to the IRR criteria.

e. Compare your answers to b, c, and d, and discuss any differences.

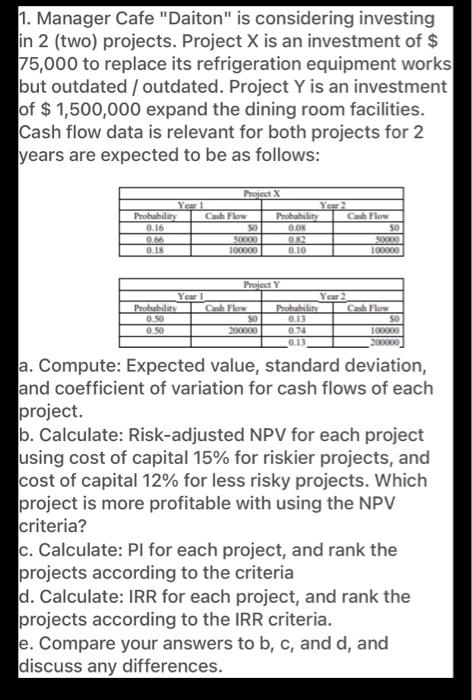

1. Manager Cafe "Daiton" is considering investing in 2 (two) projects. Project X is an investment of $ 75,000 to replace its refrigeration equipment works but outdated / outdated. Project Y is an investment of $ 1,500,000 expand the dining room facilities. Cash flow data is relevant for both projects for 2 years are expected to be as follows: Project X Year 1 Probability Cash Flow Probability 0.16 SO 0.0 0.66 50000 0.18 100000 0.10 Cash Flow SO S0000 100000 Project Y Year 1 Year Probability Cash Flow Probabil 0.50 SO 0.13 0.50 200000 0.74 0.13 100000 200000 a. Compute: Expected value, standard deviation, and coefficient of variation for cash flows of each project. b. Calculate: Risk-adjusted NPV for each project using cost of capital 15% for riskier projects, and cost of capital 12% for less risky projects. Which project is more profitable with using the NPV criteria? c. Calculate: PI for each project, and rank the projects according to the criteria d. Calculate: IRR for each project, and rank the projects according to the IRR criteria. e. Compare your answers to b, c, and d, and discuss any differences. 1. Manager Cafe "Daiton" is considering investing in 2 (two) projects. Project X is an investment of $ 75,000 to replace its refrigeration equipment works but outdated / outdated. Project Y is an investment of $ 1,500,000 expand the dining room facilities. Cash flow data is relevant for both projects for 2 years are expected to be as follows: Project X Year 1 Probability Cash Flow Probability 0.16 SO 0.0 0.66 50000 0.18 100000 0.10 Cash Flow SO S0000 100000 Project Y Year 1 Year Probability Cash Flow Probabil 0.50 SO 0.13 0.50 200000 0.74 0.13 100000 200000 a. Compute: Expected value, standard deviation, and coefficient of variation for cash flows of each project. b. Calculate: Risk-adjusted NPV for each project using cost of capital 15% for riskier projects, and cost of capital 12% for less risky projects. Which project is more profitable with using the NPV criteria? c. Calculate: PI for each project, and rank the projects according to the criteria d. Calculate: IRR for each project, and rank the projects according to the IRR criteria. e. Compare your answers to b, c, and d, and discuss any differences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts