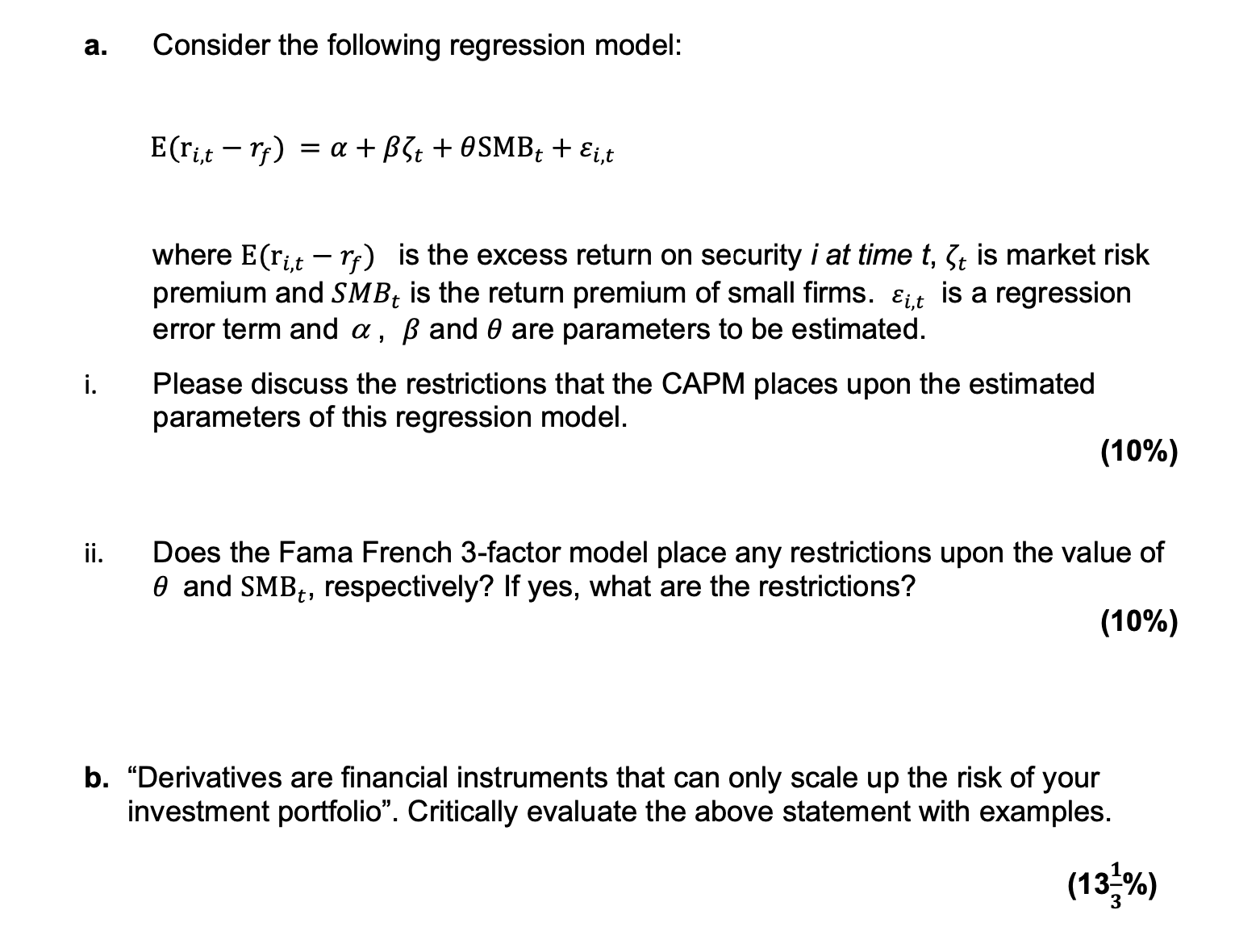

Question: a . Consider the following regression model: E ( r i , t - r f ) = + t + S M B t

a Consider the following regression model:

where is the excess return on security at time is market risk

premium and is the return premium of small firms. is a regression

error term and and are parameters to be estimated.

i Please discuss the restrictions that the CAPM places upon the estimated

parameters of this regression model.

ii Does the Fama French factor model place any restrictions upon the value of

and respectively? If yes, what are the restrictions?

b "Derivatives are financial instruments that can only scale up the risk of your

investment portfolio". Critically evaluate the above statement with examples.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock