Question: (a) Determine FDCM's competitive position by applying the Boston Consulting Group's (BCG) growth/share matrix to its products portfolio. Illustrate your BCG matrix. (b) Advise the

(a) Determine FDCM's competitive position by applying the Boston Consulting Group's (BCG) growth/share matrix to its products portfolio. Illustrate your BCG matrix.

(b) Advise the FDCM's Managing Director on the strategic direction for each of its major products based on your answer in (a).

(c) Evaluate the FDCM's strategic option to grow into the chemical business segment using the Suitability, Feasibility and Acceptability framework.

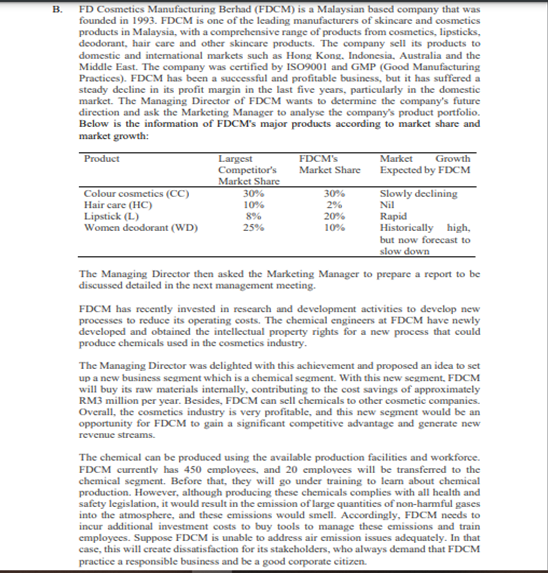

B. FD Cosmetics Manufacturing Berhad (FDCM) is a Malaysian based company that was founded in 1993. FDCM is one of the leading manufacturers of skincare and cosmetics products in Malaysia, with a comprehensive range of products from cosmetics, lipsticks, deodorant, hair care and other skincare products. The company sell its products to domestic and interational markets such as Hong Kong, Indonesia, Australia and the Middle East. The company was certified by ISO9001 and GMP (Good Manufacturing Practices). FDCM has been a successful and profitable business, but it has suffered a steady decline in its profit margin in the last five years, particularly in the domestic market. The Managing Director of FDCM wants to determine the company's future direction and ask the Marketing Manager to analyse the company's product portfolio. Below is the information of FDCM's major products according to market share and market growth: Product Largest FDCM's Market Growth Competitor's Market Share Expected by FDCM Market Share Colour cosmetics (CC) 30% 30% Slowly declining Hair care (HC) 10% 29 Nil Lipstick (L) 896 20% Rapid Women deodorant (WD) 25% 104 Historically high, but now forecast to slow down The Managing Director then asked the Marketing Manager to prepare a report to be discussed detailed in the next management meeting. FDCM has recently invested in research and development activities to develop new processes to reduce its operating costs. The chemical engineers at FDCM have newly developed and obtained the intellectual property rights for a new process that could produce chemicals used in the cosmetics industry. The Managing Director was delighted with this achievement and proposed an idea to set up a new business segment which is a chemical segment. With this new segment. FDCM will buy its raw materials intemally, contributing to the cost savings of approximately RM3 million per year. Besides, FDCM can sell chemicals to other cosmetic companies. Overall, the cosmetics industry is very profitable, and this new segment would be an opportunity for FDCM to gain a significant competitive advantage and generate new revenue streams. The chemical can be produced using the available production facilities and workforce. FDCM currently has 450 employees, and 20 employees will be transferred to the chemical segment. Before that, they will go under training to learn about chemical production. However, although producing these chemicals complies with all health and safety legislation, it would result in the emission of large quantities of non-harmful gases into the atmosphere, and these emissions would smell. Accordingly, FDCM needs to incur additional investment costs to buy tools to manage these emissions and train employees. Suppose FDCM is unable to address air emission issues adequately. In that case, this will create dissatisfaction for its stakeholders, who always demand that FDCM practice a responsible business and be a good corporate citizenStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts