Question: a ) . Develop Matlab code for pricing European options under a Black Scholes model d S t S t = r d t +

a Develop Matlab code for pricing European options under a Black Scholes model

using a finite difference method as discussed in class. Use forwardbackwardcentral differ

encing as appropriate to ensure a positive coefficient discretization. The code should be able

to use fully implicit, and CrankNicolson method.

You will have to solve a tridiagonal linear system. Use lu Matlab function to solve linear

systems. Avoid unnecessary LU factorization computation.

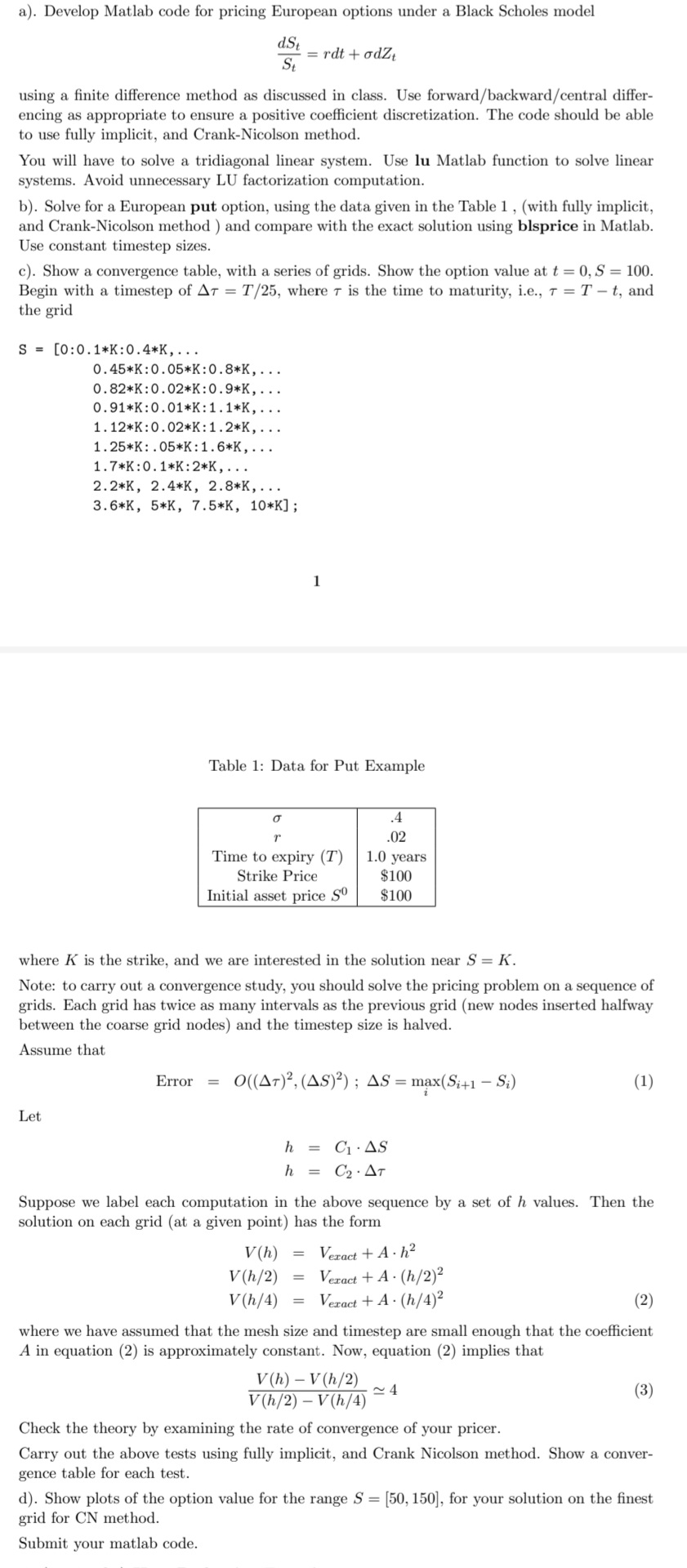

b Solve for a European put option, using the data given in the Table with fully implicit,

and CrankNicolson method and compare with the exact solution using blsprice in Matlab.

Use constant timestep sizes.

c Show a convergence table, with a series of grids. Show the option value at

Begin with a timestep of where is the time to maturity, ie and

the grid

::dots

::dots

::dots

::dots

::dots

::dots

::dots

dots

;

Table : Data for Put Example

where is the strike, and we are interested in the solution near

Note: to carry out a convergence study, you should solve the pricing problem on a sequence of

grids. Each grid has twice as many intervals as the previous grid new nodes inserted halfway

between the coarse grid nodes and the timestep size is halved.

Assume that

Error ;

Let

Suppose we label each computation in the above sequence by a set of values. Then the

solution on each grid at a given point has the form

where we have assumed that the mesh size and timestep are small enough that the coefficient

in equation is approximately constant. Now, equation implies that

Check the theory by examining the rate of convergence of your pricer.

Carry out the above tests using fully implicit, and Crank Nicolson method. Show a conver

gence table for each test.

d Show plots of the option value for the range for your solution on the finest

grid for CN method.

Submit your matlab code.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock