Question: a. Direct material price variance b. Direct material efficiency variance c. Direct labor rate /price variance d. Direct labor efficiency variance e. Variable factory overhead

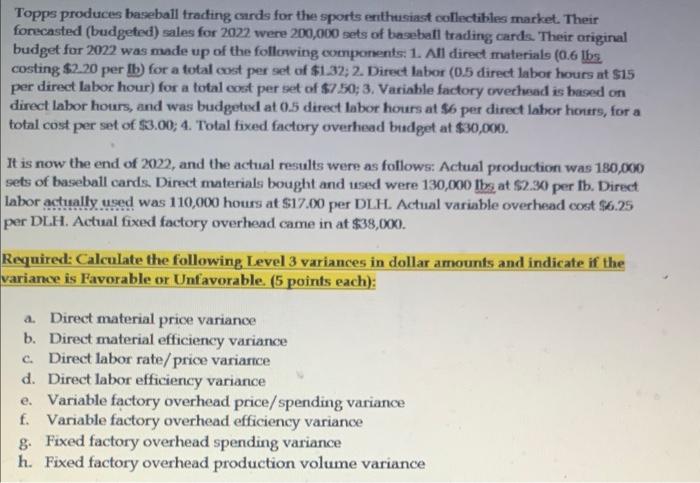

Topps produces basebail trading cards for the sports enthusiast collectibles market. Their forecasted (budgeted) sales for 2022 were 200,000 sets of baseball trading cards. Their ariginal budget for 2022 was made up of the following components: 1. All direct materials ( 0.6 lbs costing \$2.20 per ib) for a total cost per set of $1.32;2. Direct labor (0.5 direct labor hours at $15 per direct labor hour) for a total cost per set of $750;3. Variable factory overhaad is based on direct labor hours, and was budgetud at 0.5 direct labor hours at $6 per direct labor honers, for a total cost per set of \$3.00; 4. Total fixed factory overhead budget at $30,000. It is now the end of 2022 , and the actual results were as follows: Actual production was 180,000 sets of baseball cards. Direct materials bought and used were 130,000lbs at $2.30 per fb. Direct labor actually. used was 110,000 hours at $17.00 per DLH. Actual variable overhead cost $6.25 per DL.H. Actual fixed factory overhead came in at $38,000. Required: Calculate the following Level 3 variances in dollar amounts and indicate if the variance is Favorable or Unfavorable. (5 points each): a. Direct material price variance b. Direct material efficiency variance c. Direct labor rate/price variance d. Direct labor efficiency variance e. Variable factory overhead price/spending variance f. Variable factory overhead efficiency variance g. Fixed factory overhead spending variance h. Fixed factory overhead production volume variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts