Question: Suppose an investor estimates the following input data for IBM corporate bond and IBM common stock: E(m)-5% On-8% E(rs)-10% 0s-19% PBS-0.2 Assuming that portion

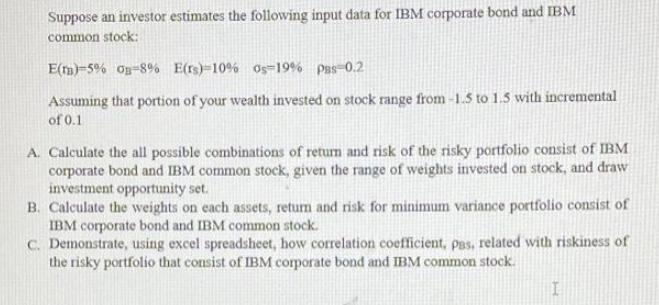

Suppose an investor estimates the following input data for IBM corporate bond and IBM common stock: E(m)-5% On-8% E(rs)-10% 0s-19% PBS-0.2 Assuming that portion of your wealth invested on stock range from-1.5 to 1.5 with incremental of 0.1 A. Calculate the all possible combinations of return and risk of the risky portfolio consist of IBM corporate bond and IBM common stock, given the range of weights invested on stock, and draw investment opportunity set. B. Calculate the weights on each assets, return and risk for minimum variance portfolio consist of IBM corporate bond and IBM common stock. C. Demonstrate, using excel spreadsheet, how correlation coefficient, pas, related with riskiness of the risky portfolio that consist of IBM corporate bond and IBM common stock. I

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Expected ReturnER StdDeviationSD Stock S 10 19 Bond B 5 8 correlationr 02 ErpSERSBERB SDpSQRTwS2SDS2... View full answer

Get step-by-step solutions from verified subject matter experts