Question: (a) Draw the payout profile for the following two call spread portfolios. (i) +1 K call and 1 (K + 1) call. (ii) +2 K

(a) Draw the payout profile for the following two call spread portfolios.

(i) +1 K call and –1 (K + 1) call.

(ii) +2 K calls and –2 (K + 0.5) calls.

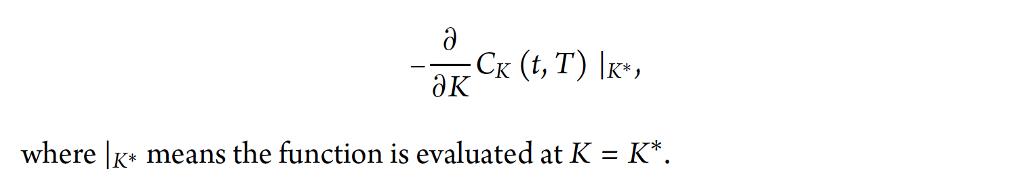

(b) By constructing a series of portfolios of call spreads and taking limits, prove that the price at time t of a digital call, with strike K∗ and payout 1, is given by

(c) Write down the equivalent formula for a digital put option in terms of put prices.

(d) By examining the payout profile, derive a put-call parity relationship for the digital call and digital put.

k CK (t, T) |K*, where K* means the function is evaluated at K = K*.

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

To address the question well examine each part step by step a Draw the payout profile for the following two call spread portfolios i 1 K call and 1 K ... View full answer

Get step-by-step solutions from verified subject matter experts