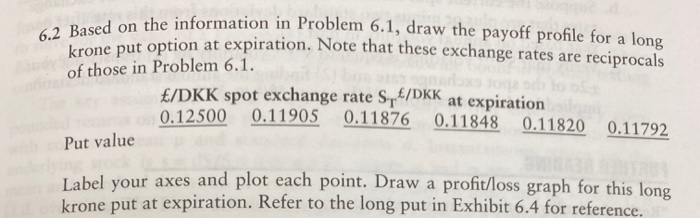

Question: aced on the information in Problem 6.1, draw the payoff profile for a long option at expiration. Note that these exchange rates are reciprocals krone

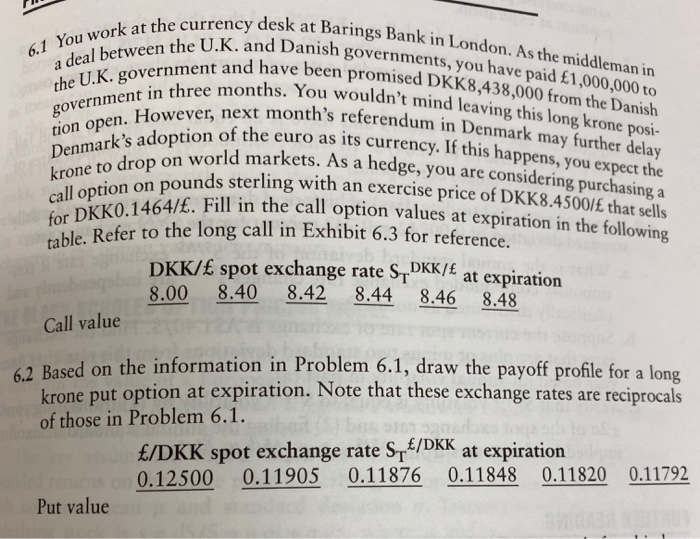

aced on the information in Problem 6.1, draw the payoff profile for a long option at expiration. Note that these exchange rates are reciprocals krone put option at expiration. N of those in Problem 6.1. /DKK spot exchange rate S /DKK at expiration 0.12500 0.11905 0.11876 0.11848 0.11820 0.11792 Put value Label your axes and plot each point. Draw a profit/loss graph for this long Drone put at expiration. Refer to the long put in Exhibit 6.4 for reference. 61 You work at the currency a deal between the U.K. a the U.K. government and have vernment in three months. You rency desk at Barings Bank in London. As the middlemanin Danish governments, you have paid 1,000,000 to ind have been promised DKK8,438,000 from the Danish ths. You wouldn't mind leaving this long krone posi- th's referendum in Denmark may further delay of the euro as its currency. If this happens, you expect the world markets. As a hedge, you are considering purchasing a n. However, next month's referendum in tion open. Howeve Denmark's adoption of the eur krone to drop on world marker call option on pounds sterline for DKKO.1464/. Fill in th table. Refer to the long cal pounds sterling with an exercise price of DKK8.4500/ that sells 1464/. Fill in the call option values at expiration in the following efer to the long call in Exhibit 6.3 for reference. DKK/ spot exchange rate S, Dkk/t at expiration 8.00 8.40 8.42 8.44 8.46 8.48 Call value e information in Problem 6.1, draw the payoff profile for a long Leone put option at expiration. Note that these exchange rates are reciprocals of those in Problem 6.1. /DKK spot exchange rate SE/DKK at expiration 0.12500 0.11905 0.11876 0.11848 0.11820 0.11792 Put value aced on the information in Problem 6.1, draw the payoff profile for a long option at expiration. Note that these exchange rates are reciprocals krone put option at expiration. N of those in Problem 6.1. /DKK spot exchange rate S /DKK at expiration 0.12500 0.11905 0.11876 0.11848 0.11820 0.11792 Put value Label your axes and plot each point. Draw a profit/loss graph for this long Drone put at expiration. Refer to the long put in Exhibit 6.4 for reference. 61 You work at the currency a deal between the U.K. a the U.K. government and have vernment in three months. You rency desk at Barings Bank in London. As the middlemanin Danish governments, you have paid 1,000,000 to ind have been promised DKK8,438,000 from the Danish ths. You wouldn't mind leaving this long krone posi- th's referendum in Denmark may further delay of the euro as its currency. If this happens, you expect the world markets. As a hedge, you are considering purchasing a n. However, next month's referendum in tion open. Howeve Denmark's adoption of the eur krone to drop on world marker call option on pounds sterline for DKKO.1464/. Fill in th table. Refer to the long cal pounds sterling with an exercise price of DKK8.4500/ that sells 1464/. Fill in the call option values at expiration in the following efer to the long call in Exhibit 6.3 for reference. DKK/ spot exchange rate S, Dkk/t at expiration 8.00 8.40 8.42 8.44 8.46 8.48 Call value e information in Problem 6.1, draw the payoff profile for a long Leone put option at expiration. Note that these exchange rates are reciprocals of those in Problem 6.1. /DKK spot exchange rate SE/DKK at expiration 0.12500 0.11905 0.11876 0.11848 0.11820 0.11792 Put value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts