Question: a) Explain how triple constraints allow the project manager to direct the progress of the 2 plan. b) Explain how triple constraints allow the project

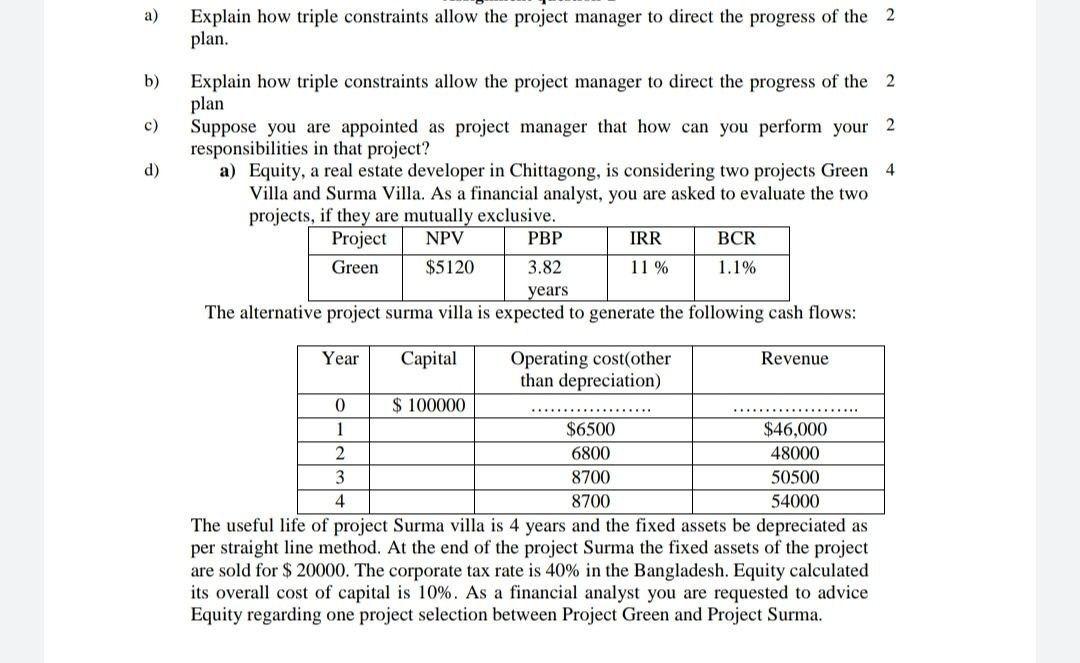

a) Explain how triple constraints allow the project manager to direct the progress of the 2 plan. b) Explain how triple constraints allow the project manager to direct the progress of the 2 plan C) d) Suppose you are appointed as project manager that how can you perform your 2 responsibilities in that project? a) Equity, a real estate developer in Chittagong, is considering two projects Green 4 Villa and Surma Villa. As a financial analyst, you are asked to evaluate the two projects, if they are mutually exclusive. Project NPV PBP IRR BCR Green $5120 3.82 11 % 1.1% years The alternative project surma villa is expected to generate the following cash flows: Year Capital Operating cost(other Revenue than depreciation) 0 $ 100000 1 $6500 $46,000 2 6800 48000 3 8700 50500 4 8700 54000 The useful life of project Surma villa is 4 years and the fixed assets be depreciated as per straight line method. At the end of the project Surma the fixed assets of the project are sold for $ 20000. The corporate tax rate is 40% in the Bangladesh. Equity calculated its overall cost of capital is 10%. As a financial analyst you are requested to advice Equity regarding one project selection between Project Green and Project Surma. a) Explain how triple constraints allow the project manager to direct the progress of the 2 plan. b) Explain how triple constraints allow the project manager to direct the progress of the 2 plan C) d) Suppose you are appointed as project manager that how can you perform your 2 responsibilities in that project? a) Equity, a real estate developer in Chittagong, is considering two projects Green 4 Villa and Surma Villa. As a financial analyst, you are asked to evaluate the two projects, if they are mutually exclusive. Project NPV PBP IRR BCR Green $5120 3.82 11 % 1.1% years The alternative project surma villa is expected to generate the following cash flows: Year Capital Operating cost(other Revenue than depreciation) 0 $ 100000 1 $6500 $46,000 2 6800 48000 3 8700 50500 4 8700 54000 The useful life of project Surma villa is 4 years and the fixed assets be depreciated as per straight line method. At the end of the project Surma the fixed assets of the project are sold for $ 20000. The corporate tax rate is 40% in the Bangladesh. Equity calculated its overall cost of capital is 10%. As a financial analyst you are requested to advice Equity regarding one project selection between Project Green and Project Surma

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts