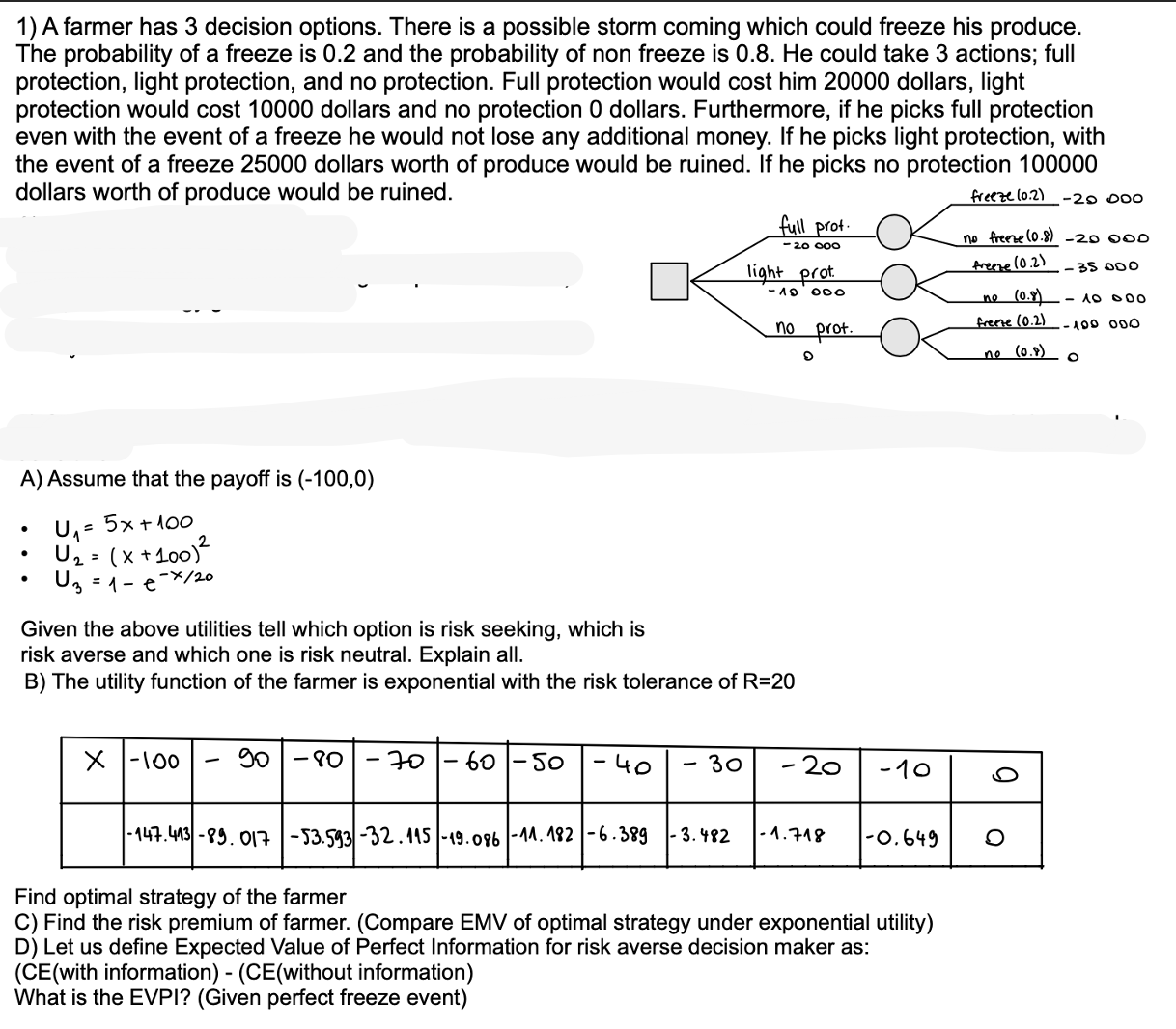

Question: A farmer has 3 decision options. There is a possible storm coming which could freeze his produce. The probability of a freeze is 0 .

A farmer has decision options. There is a possible storm coming which could freeze his produce.

The probability of a freeze is and the probability of non freeze is He could take actions; full

protection, light protection, and no protection. Full protection would cost him dollars, light

protection would cost dollars and no protection dollars. Furthermore, if he picks full protection

even with the event of a freeze he would not lose any additional money. If he picks light protection, with

the event of a freeze dollars worth of produce would be ruined. If he picks no protection

dollars worth of produce would be ruined.

A Assume that the payoff is

Given the above utilities tell which option is risk seeking, which is

risk averse and which one is risk neutral. Explain all.

B The utility function of the farmer is exponential with the risk tolerance of

Find optimal strategy of the farmer

C Find the risk premium of farmer. Compare EMV of optimal strategy under exponential utility

D Let us define Expected Value of Perfect Information for risk averse decision maker as:

CEwith informationCEwithout information

What is the EVPI? Given perfect freeze event

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock