Question: a. HOW will you detine risk and return! b. What is CAPM and SML Model? c. What is beta? d. As a financial analyst How

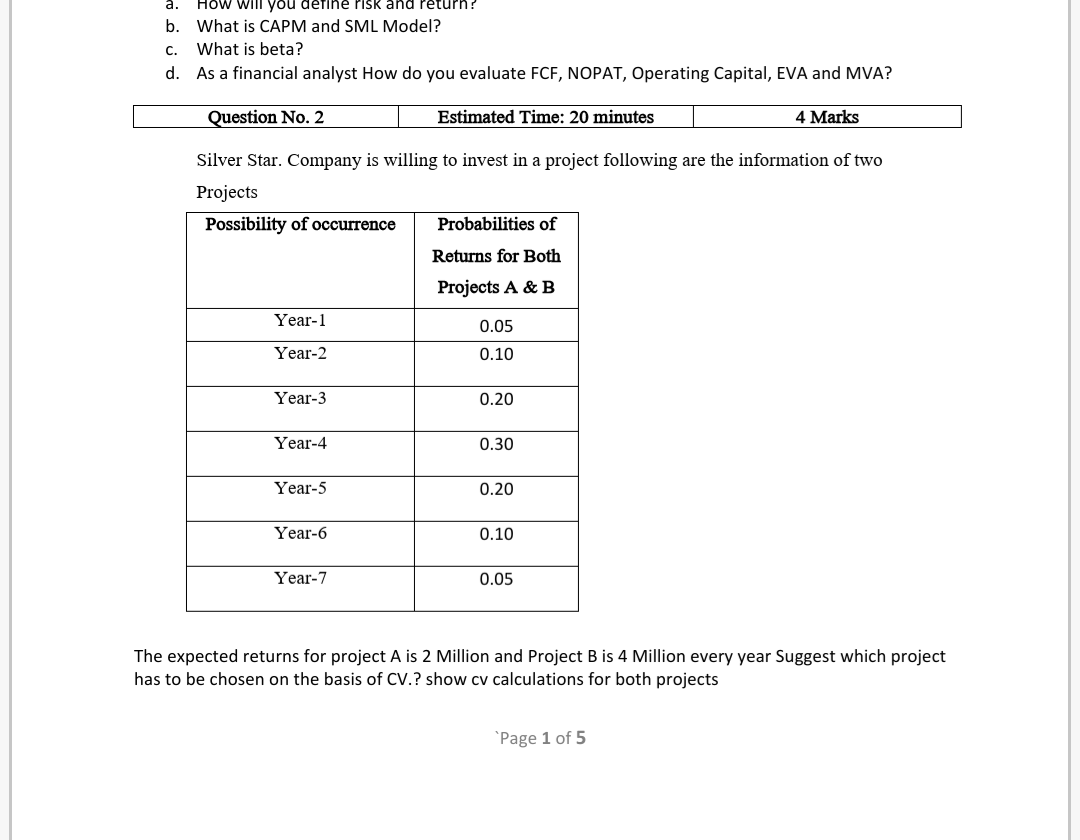

a. HOW will you detine risk and return! b. What is CAPM and SML Model? c. What is beta? d. As a financial analyst How do you evaluate FCF, NOPAT, Operating Capital, EVA and MVA? Question No. 2 Estimated Time: 20 minutes 4 Marks Silver Star. Company is willing to invest in a project following are the information of two Projects Possibility of occurrence Probabilities of Returns for Both Projects A&B Year-1 0.05 Year-2 0.10 Year-3 0.20 Year-4 0.30 Year-5 0.20 Year-6 0.10 Year-7 0.05 The expected returns for project A is 2 Million and Project B is 4 Million every year Suggest which project has to be chosen on the basis of CV.? show cv calculations for both projects Page 1 of 5 a. HOW will you detine risk and return! b. What is CAPM and SML Model? c. What is beta? d. As a financial analyst How do you evaluate FCF, NOPAT, Operating Capital, EVA and MVA? Question No. 2 Estimated Time: 20 minutes 4 Marks Silver Star. Company is willing to invest in a project following are the information of two Projects Possibility of occurrence Probabilities of Returns for Both Projects A&B Year-1 0.05 Year-2 0.10 Year-3 0.20 Year-4 0.30 Year-5 0.20 Year-6 0.10 Year-7 0.05 The expected returns for project A is 2 Million and Project B is 4 Million every year Suggest which project has to be chosen on the basis of CV.? show cv calculations for both projects Page 1 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts