Question: A large open-pit copper mine is considering upgrading its trucks with a fleet of self-driving trucks. The current drivers will laid off and paid severance.

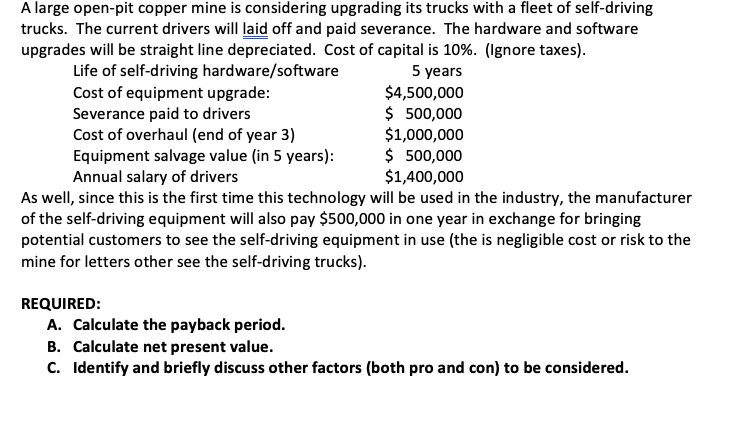

A large open-pit copper mine is considering upgrading its trucks with a fleet of self-driving trucks. The current drivers will laid off and paid severance. The hardware and software upgrades will be straight line depreciated. Cost of capital is 10%. (Ignore taxes). Life of self-driving hardware/software 5 years Cost of equipment upgrade: $4,500,000 Severance paid to drivers $ 500,000 Cost of overhaul (end of year 3) $1,000,000 Equipment salvage value (in 5 years): $ 500,000 Annual salary of drivers $1,400,000 As well, since this is the first time this technology will be used in the industry, the manufacturer of the self-driving equipment will also pay $500,000 in one year in exchange for bringing potential customers to see the self-driving equipment in use (the is negligible cost or risk to the mine for letters other see the self-driving trucks). REQUIRED: A. Calculate the payback period. B. Calculate net present value. C. Identify and briefly discuss other factors (both pro and con) to be considered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts