Question: A Monte Carlo simulation of a complex project has shown that in 20% of instances your project could over-run its deadline incurring added cost and

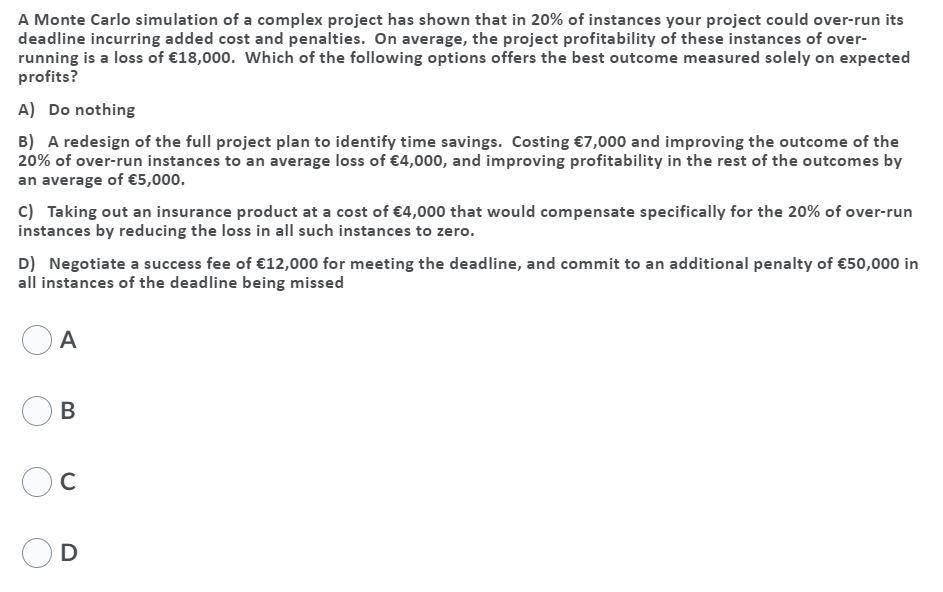

A Monte Carlo simulation of a complex project has shown that in 20% of instances your project could over-run its deadline incurring added cost and penalties. On average, the project profitability of these instances of over- running is a loss of 18,000. Which of the following options offers the best outcome measured solely on expected profits? A) Do nothing B) A redesign of the full project plan to identify time savings. Costing 7,000 and improving the outcome of the 20% of over-run instances to an average loss of 4,000, and improving profitability in the rest of the outcomes by an average of 5,000. C) Taking out an insurance product at a cost of 4,000 that would compensate specifically for the 20% of over-run instances by reducing the loss in all such instances to zero. D) Negotiate a success fee of 12,000 for meeting the deadline, and commit to an additional penalty of 50,000 in all instances of the deadline being missed B Oc D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts