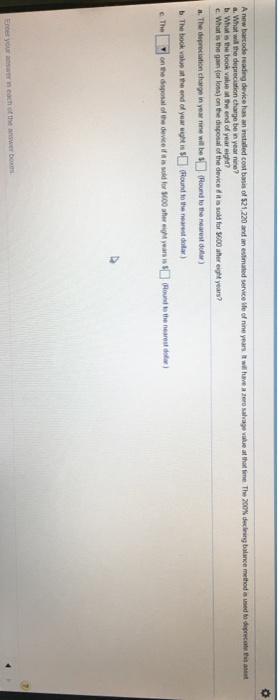

Question: A new barcode reading device has an installed cost basis of $21.220 and an estimated service to of nine years. It will have a zero

A new barcode reading device has an installed cost basis of $21.220 and an estimated service to of nine years. It will have a zero salvage value at that time. The 200% declining balance method is used to depreciate the a. What will the depreciation charge be in year nine? b. What is the book value at the end of year eight? c. What is the gain for loss) on the disposal of the device it is sold for $600 after eight year? a. The depreciation charge in your nine will be (Round to the nearest dollar) The book value at the end of year eight is 5 Round to the nearest dolar) on the doposal of the device is sold for some years is 8 Round to the nearest dolar) The Enter your answer in each of the answer boxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts