Question: a. New Jersey Glimpse is thinking about introducing their new product as a part of their expansion plan which they have been planning over

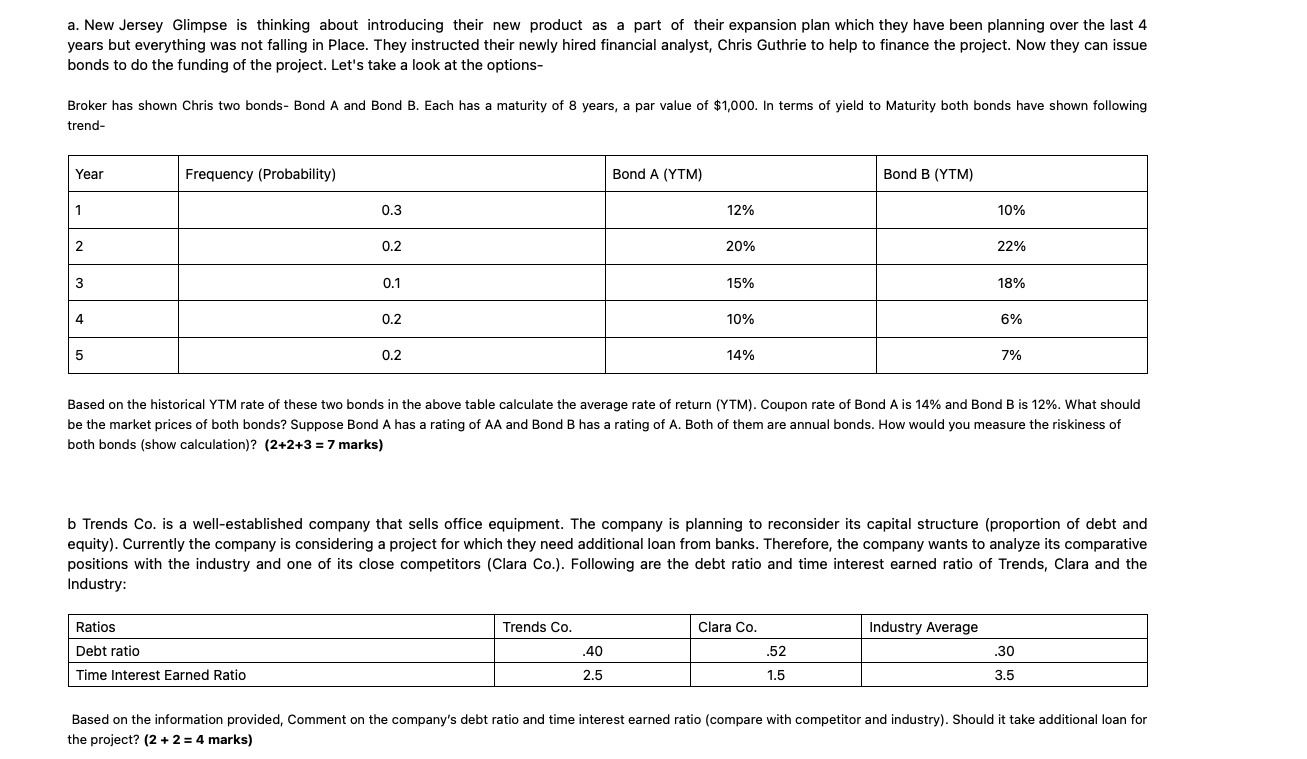

a. New Jersey Glimpse is thinking about introducing their new product as a part of their expansion plan which they have been planning over the last 4 years but everything was not falling in Place. They instructed their newly hired financial analyst, Chris Guthrie to help to finance the project. Now they can issue bonds to do the funding of the project. Let's take a look at the options- Broker has shown Chris two bonds- Bond A and Bond B. Each has a maturity of 8 years, a par value of $1,000. In terms of yield to Maturity both bonds have shown following trend- Year 1 2 3 4 5 Frequency (Probability) 0.3 0.2 Ratios Debt ratio Time Interest Earned Ratio 0.1 0.2 0.2 Bond A (YTM) Trends Co. 12% .40 2.5 20% 15% 10% 14% Bond B (YTM) Clara Co. Based on the historical YTM rate of these two bonds in the above table calculate the average rate of return (YTM). Coupon rate of Bond A is 14% and Bond B is 12%. What should be the market prices of both bonds? Suppose Bond A has a rating of AA and Bond B has a rating of A. Both of them are annual bonds. How would you measure the riskiness of both bonds (show calculation)? (2+2+3 = 7 marks) .52 1.5 10% b Trends Co. is a well-established company that sells office equipment. The company is planning to reconsider its capital structure (proportion of debt and equity). Currently the company is considering a project for which they need additional loan from banks. Therefore, the company wants to analyze its comparative positions with the industry and one of its close competitors (Clara Co.). Following are the debt ratio and time interest earned ratio of Trends, Clara and the Industry: 22% Industry Average 18% 6% 7% .30 3.5 Based on the information provided, Comment on the company's debt ratio and time interest earned ratio (compare with competitor and industry). Should it take additional loan for the project? (2 + 2 = 4 marks)

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

a To calculate the average rate of return YTM for each bond we can use the provided yield to maturity rates and their corresponding probabilities For ... View full answer

Get step-by-step solutions from verified subject matter experts