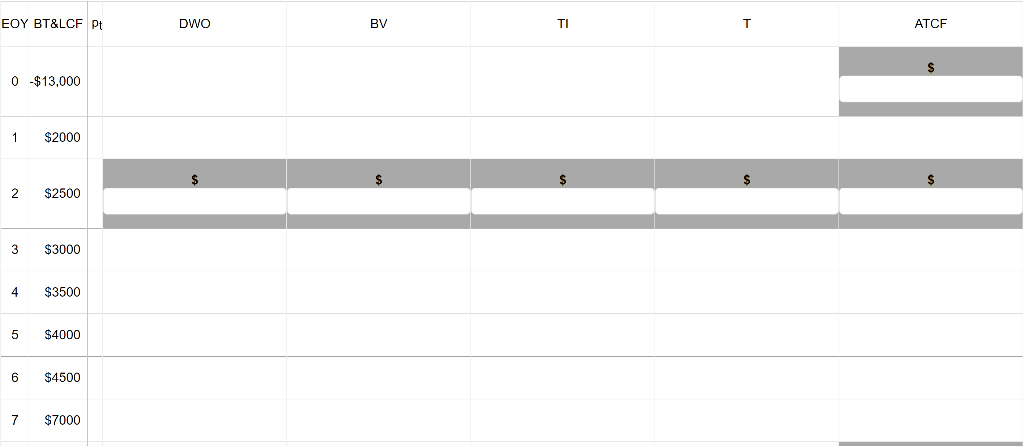

Question: A numerically controlled (NC) machine tool is purchased for $13,000. The equipment qualifies as 5-year equipment for MACRS-GDS depreciation. The BTCF profile for the acquisition,

A numerically controlled (NC) machine tool is purchased for $13,000. The equipment qualifies as 5-year equipment for MACRS-GDS depreciation. The BTCF profile for the acquisition, given below, includes a $2000 salvage value at the end of the 7-year planning horizon. Income taxes are 25% per year. The ATMARR is 7%. Solve for the values in the shaded cells below. Use exact numbers in your calculations to ensure precision. Enter your final answers in the spaces provided, showing calculated dollar values to the nearest dollar. Do not enter the $ sign, e.g. $2743.58 would be 2744. Round interest rates to one decimal place, e.g., 10.48% is 10.5

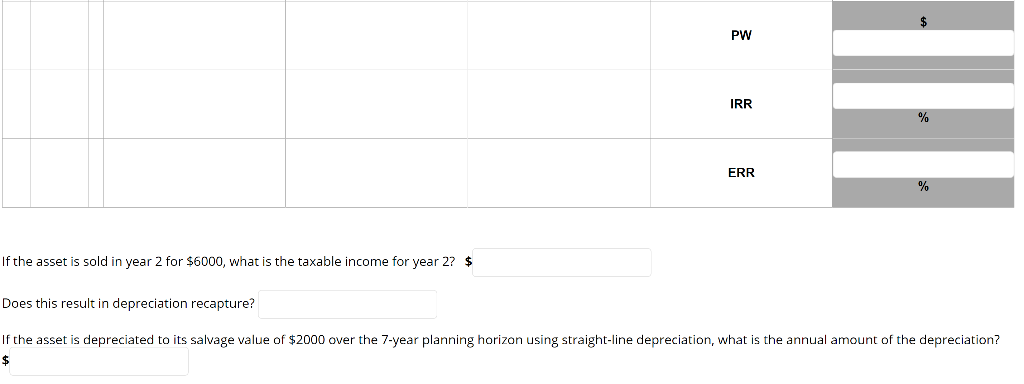

EOY BT&LCF Pt DWO BV TI T ATCF $ 0 $13,000 1 $2000 2 $2500 3 $3000 4 $3500 5 $4000 6 $4500 7 $7000 PW IRR % ERR % If the asset is sold in year 2 for $6000, what is the taxable income for year 2? $ Does this result in depreciation recapture? If the asset is depreciated to its salvage value of $2000 over the 7-year planning horizon using straight-line depreciation, what is the annual amount of the depreciation? $ EOY BT&LCF Pt DWO BV TI T ATCF $ 0 $13,000 1 $2000 2 $2500 3 $3000 4 $3500 5 $4000 6 $4500 7 $7000 PW IRR % ERR % If the asset is sold in year 2 for $6000, what is the taxable income for year 2? $ Does this result in depreciation recapture? If the asset is depreciated to its salvage value of $2000 over the 7-year planning horizon using straight-line depreciation, what is the annual amount of the depreciation? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts