Question: A numerically controlled (NC) machine tool is purchased for $800,000. The equipment qualifies as 5-year equipment for MACRS depreciation. The BTCF profile for the acquisition,

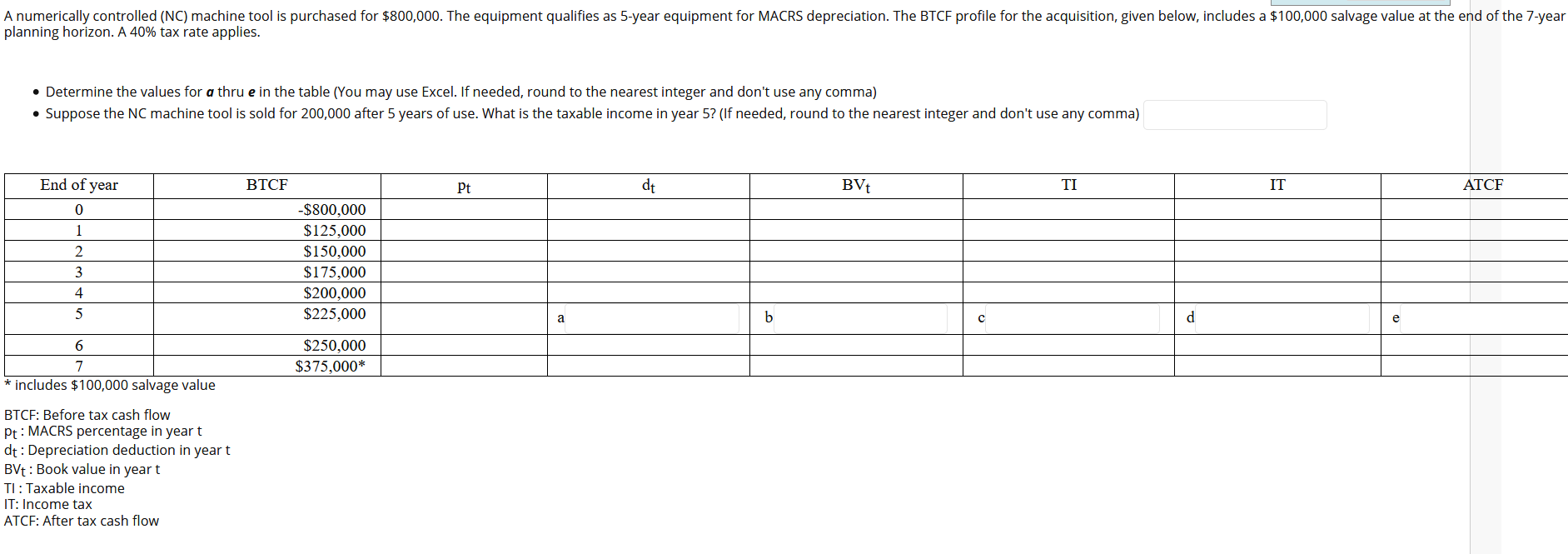

A numerically controlled (NC) machine tool is purchased for $800,000. The equipment qualifies as 5-year equipment for MACRS depreciation. The BTCF profile for the acquisition, given below, includes a $100,000 salvage value at the end of the 7-year planning horizon. A 40% tax rate applies. Determine the values for a thru e in the table (You may use Excel. If needed, round to the nearest integer and don't use any comma) Suppose the NC machine tool is sold for 200,000 after 5 years of use. What is the taxable income in year 5? (If needed, round to the nearest integer and don't use any comma) End of year BTCF Pt dt BV TI IT ATCF 0 1 2 3 -$800,000 $125,000 $150,000 $175,000 $200,000 $225,000 4 5 a b d e 6 $250,000 $375,000* 7 * includes $100,000 salvage value BTCE: Before tax cash flow Pt: MACRS percentage in yeart dt: Depreciation deduction in yeart BVt: Book value in yeart TI: Taxable income IT: Income tax ATCE: After tax cash flow A numerically controlled (NC) machine tool is purchased for $800,000. The equipment qualifies as 5-year equipment for MACRS depreciation. The BTCF profile for the acquisition, given below, includes a $100,000 salvage value at the end of the 7-year planning horizon. A 40% tax rate applies. Determine the values for a thru e in the table (You may use Excel. If needed, round to the nearest integer and don't use any comma) Suppose the NC machine tool is sold for 200,000 after 5 years of use. What is the taxable income in year 5? (If needed, round to the nearest integer and don't use any comma) End of year BTCF Pt dt BV TI IT ATCF 0 1 2 3 -$800,000 $125,000 $150,000 $175,000 $200,000 $225,000 4 5 a b d e 6 $250,000 $375,000* 7 * includes $100,000 salvage value BTCE: Before tax cash flow Pt: MACRS percentage in yeart dt: Depreciation deduction in yeart BVt: Book value in yeart TI: Taxable income IT: Income tax ATCE: After tax cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts