Question: A numerically controlled (NC) machine tool is purchased for $800,000. The equipment qualifies as 5-year equipment for MACRS depreciation. The BTCF profile for the acquisition,

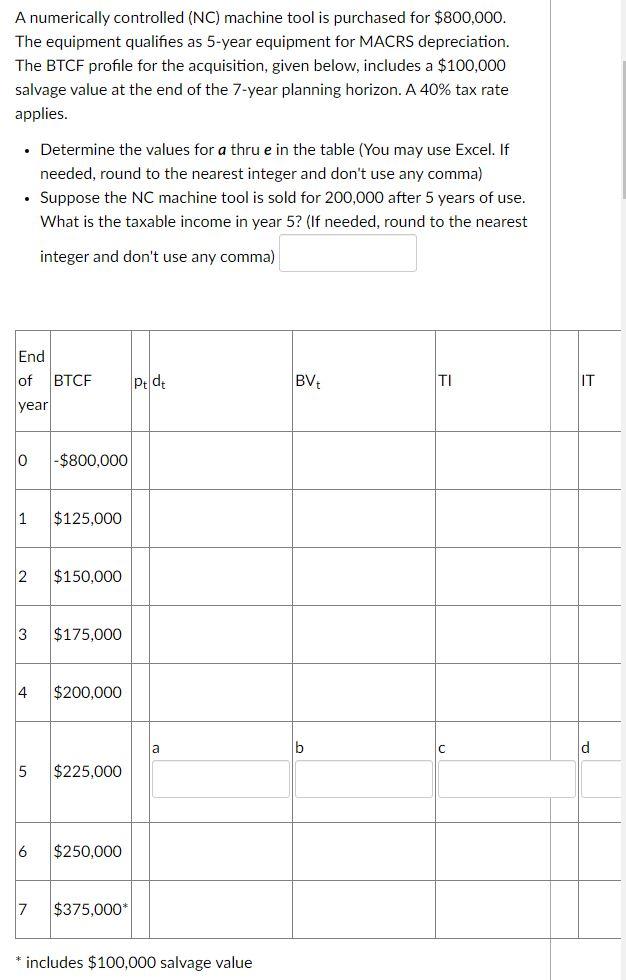

A numerically controlled (NC) machine tool is purchased for $800,000. The equipment qualifies as 5-year equipment for MACRS depreciation. The BTCF profile for the acquisition, given below, includes a $100,000 salvage value at the end of the 7-year planning horizon. A 40% tax rate applies. Determine the values for a thru e in the table (You may use Excel. If needed, round to the nearest integer and don't use any comma) . Suppose the NC machine tool is sold for 200,000 after 5 years of use. What is the taxable income in year 5? (If needed, round to the nearest integer and don't use any comma) End of BTCF Pt dt TI year 0 -$800,000 1 $125,000 2 $150,000 3 $175,000 4 $200,000 5 $225,000 6 $250,000 7 $375,000* * includes $100,000 salvage value a BV lb IT ld

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts