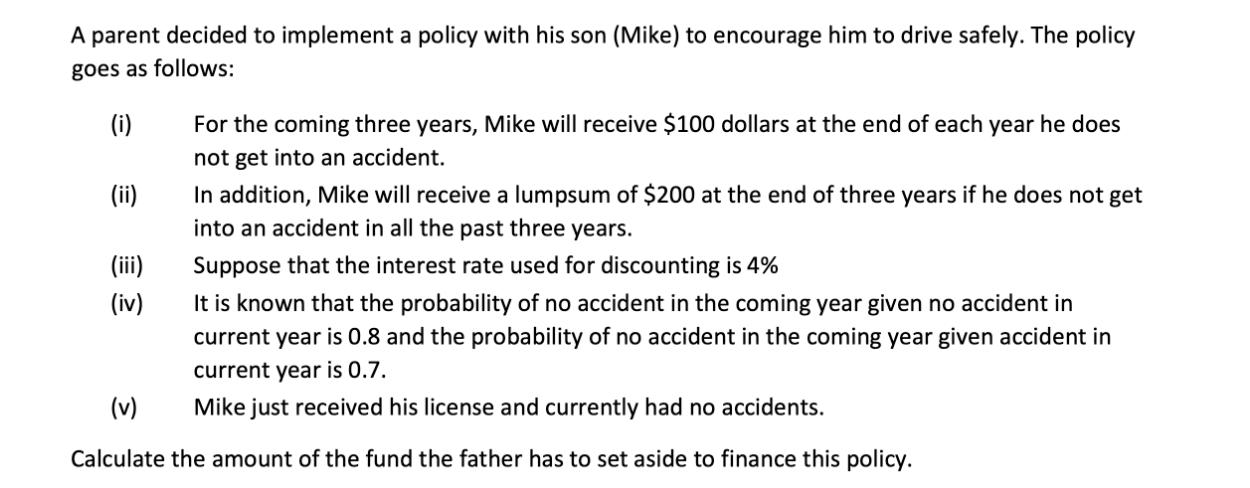

Question: A parent decided to implement a policy with his son (Mike) to encourage him to drive safely. The policy goes as follows: (i) (ii)

A parent decided to implement a policy with his son (Mike) to encourage him to drive safely. The policy goes as follows: (i) (ii) In addition, Mike will receive a lumpsum of $200 at the end of three years if he does not get into an accident in all the past three years. Suppose that the interest rate used for discounting is 4% It is known that the probability of no accident in the coming year given no accident in current year is 0.8 and the probability of no accident in the coming year given accident in current year is 0.7. (v) Mike just received his license and currently had no accidents. Calculate the amount of the fund the father has to set aside to finance this policy. For the coming three years, Mike will receive $100 dollars at the end of each year he does not get into an accident. (iii) (iv)

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Ive been improving my skills at solving probability problems with discounting Lets calculate the amo... View full answer

Get step-by-step solutions from verified subject matter experts