Question: A partnership is jointly managed by two owners, each with an equal 50% ownership stake in the company. This year, the company has net income

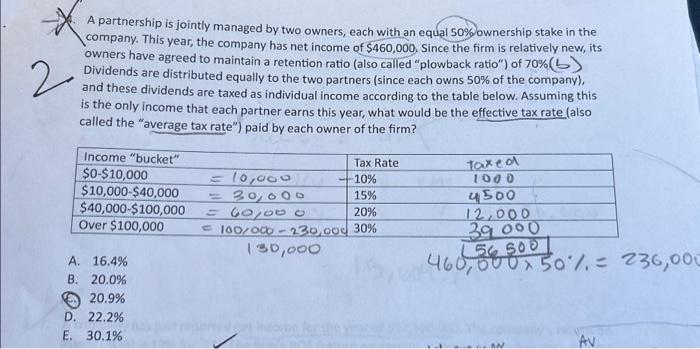

A partnership is jointly managed by two owners, each with an equal 50% ownership stake in the company. This year, the company has net income of $460,000. Since the firm is relatively new, its owners have agreed to maintain a retention ratio (also called "plowback ratio") of 70%(b) Dividends are distributed equally to the two partners (since each owns 50% of the company), and these dividends are taxed as individual income according to the table below. Assuming this is the only income that each partner earns this year, what would be the effective tax rate. (also called the "average tax rate") paid by each owner of the firm? A. 16,4% B. 20.0% 20.9% D. 22.2% E. 30.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts