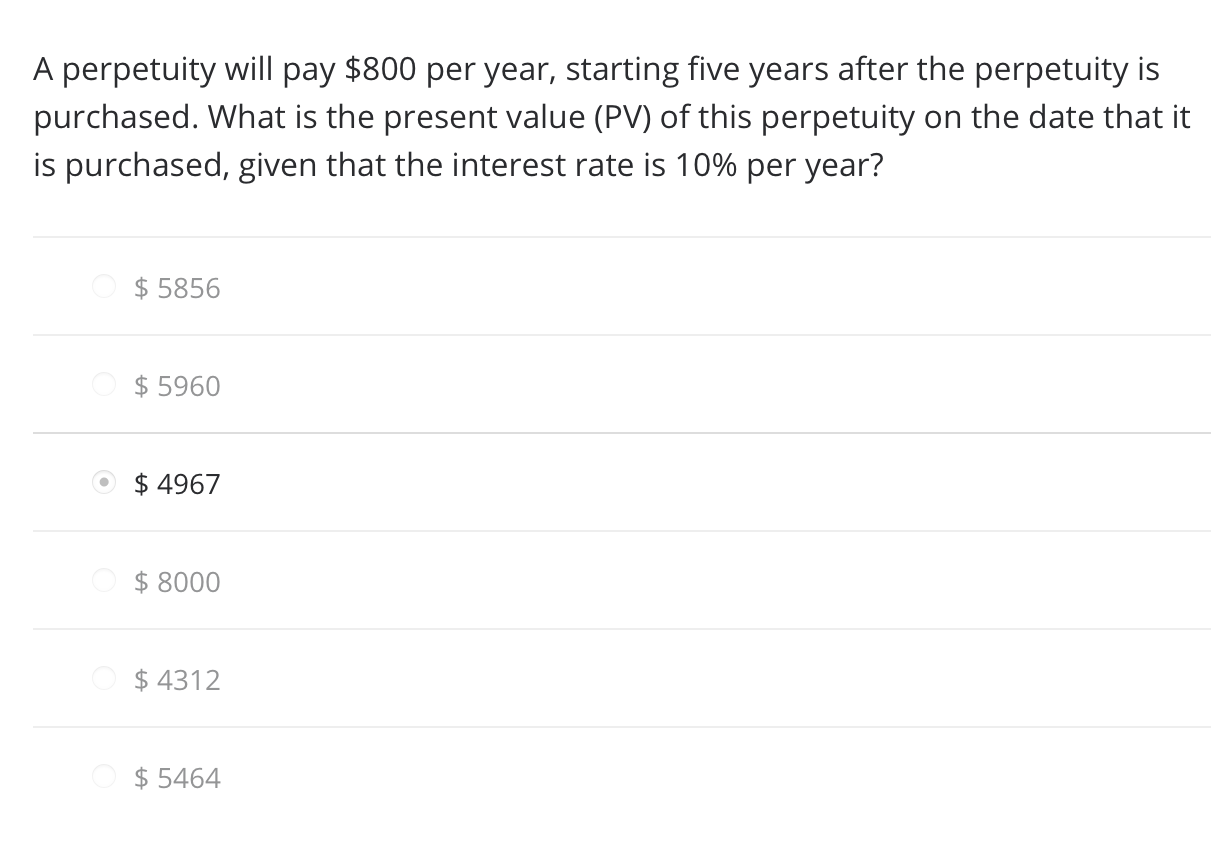

Question: A perpetuity will pay $800 per year, starting five years after the perpetuity is purchased. What is the present value (PV) of this perpetuity on

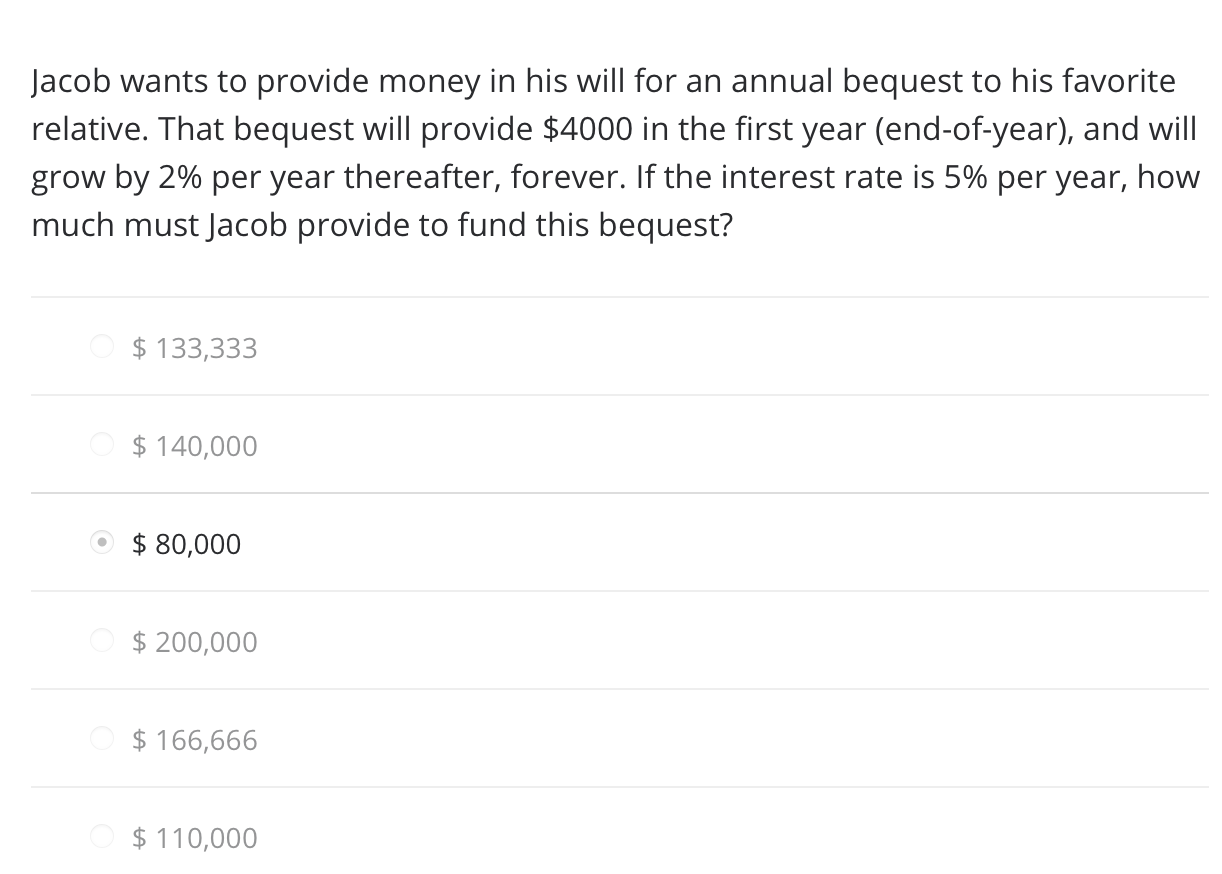

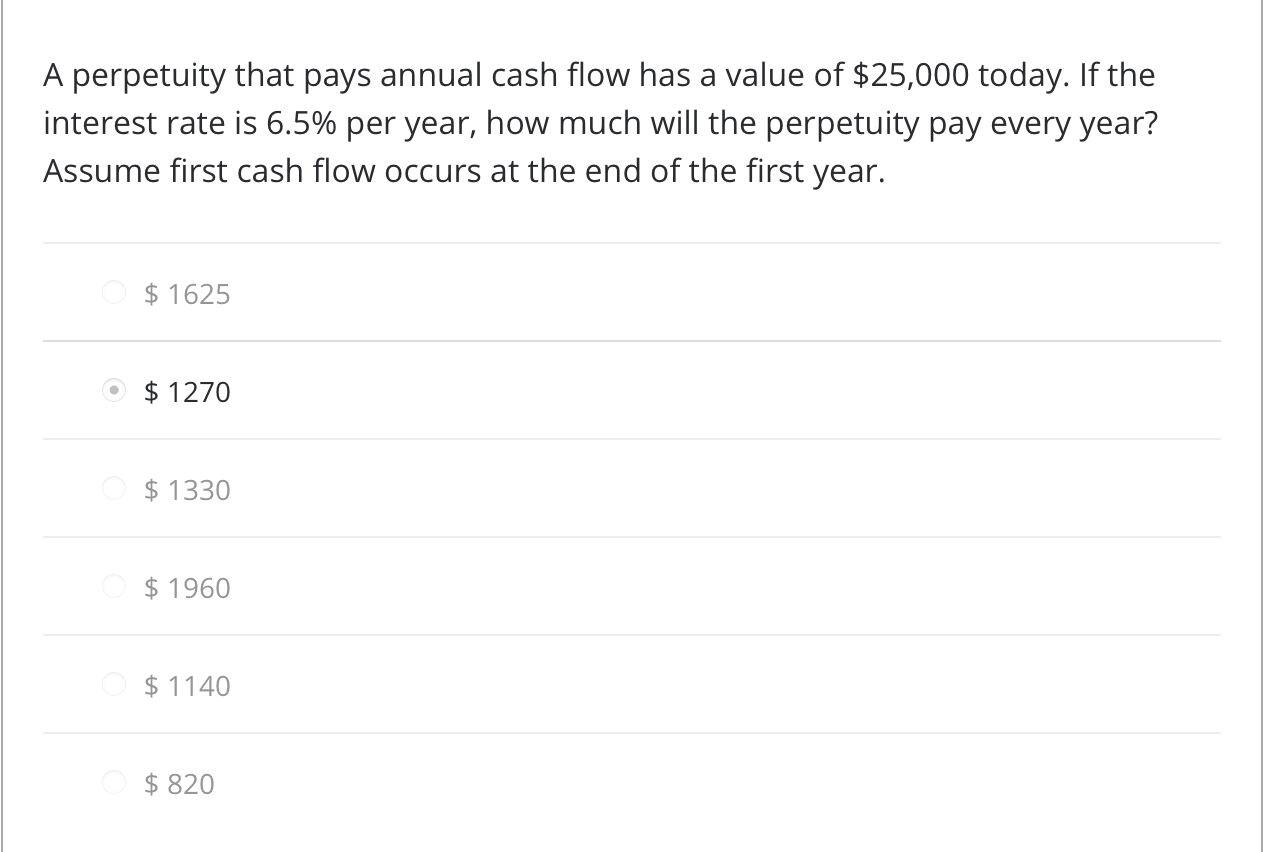

A perpetuity will pay $800 per year, starting five years after the perpetuity is purchased. What is the present value (PV) of this perpetuity on the date that it is purchased, given that the interest rate is 10% per year? $ 5856 $ 5960 $ 4967 $ 8000 $ 4312 $ 5464 Jacob wants to provide money in his will for an annual bequest to his favorite relative. That bequest will provide $4000 in the first year (end-of-year), and will grow by 2% per year thereafter, forever. If the interest rate is 5% per year, how much must Jacob provide to fund this bequest? $ 133,333 $ 140,000 $ 80,000 $ 200,000 $ 166,666 $ 110,000 A perpetuity that pays annual cash flow has a value of $25,000 today. If the interest rate is 6.5% per year, how much will the perpetuity pay every year? Assume first cash flow occurs at the end of the first year. $ 1625 $ 1270 $ 1330 $ 1960 $ 1140 $ 820

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts