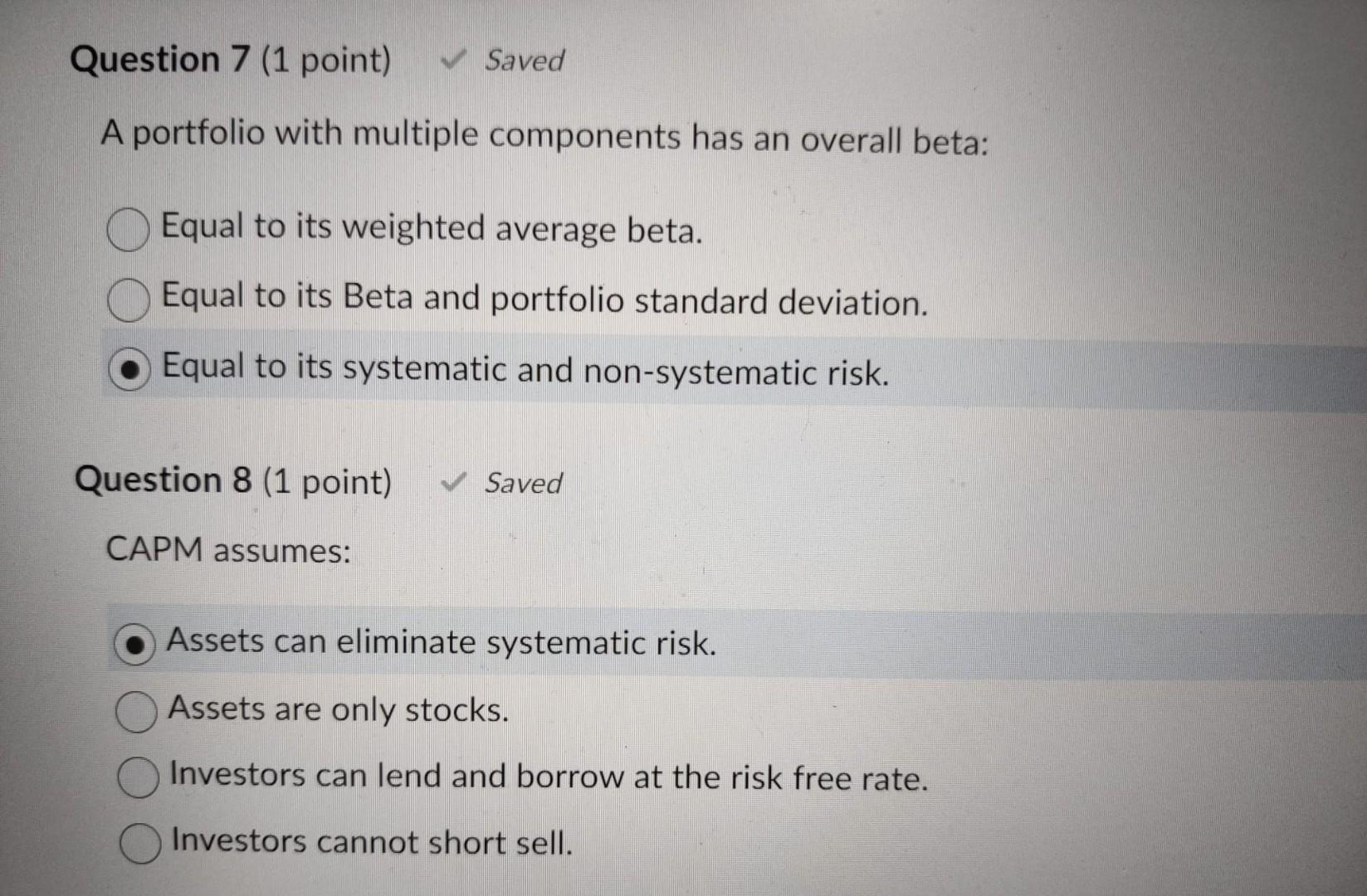

Question: A portfolio with multiple components has an overall beta: Equal to its weighted average beta. Equal to its Beta and portfolio standard deviation. Equal to

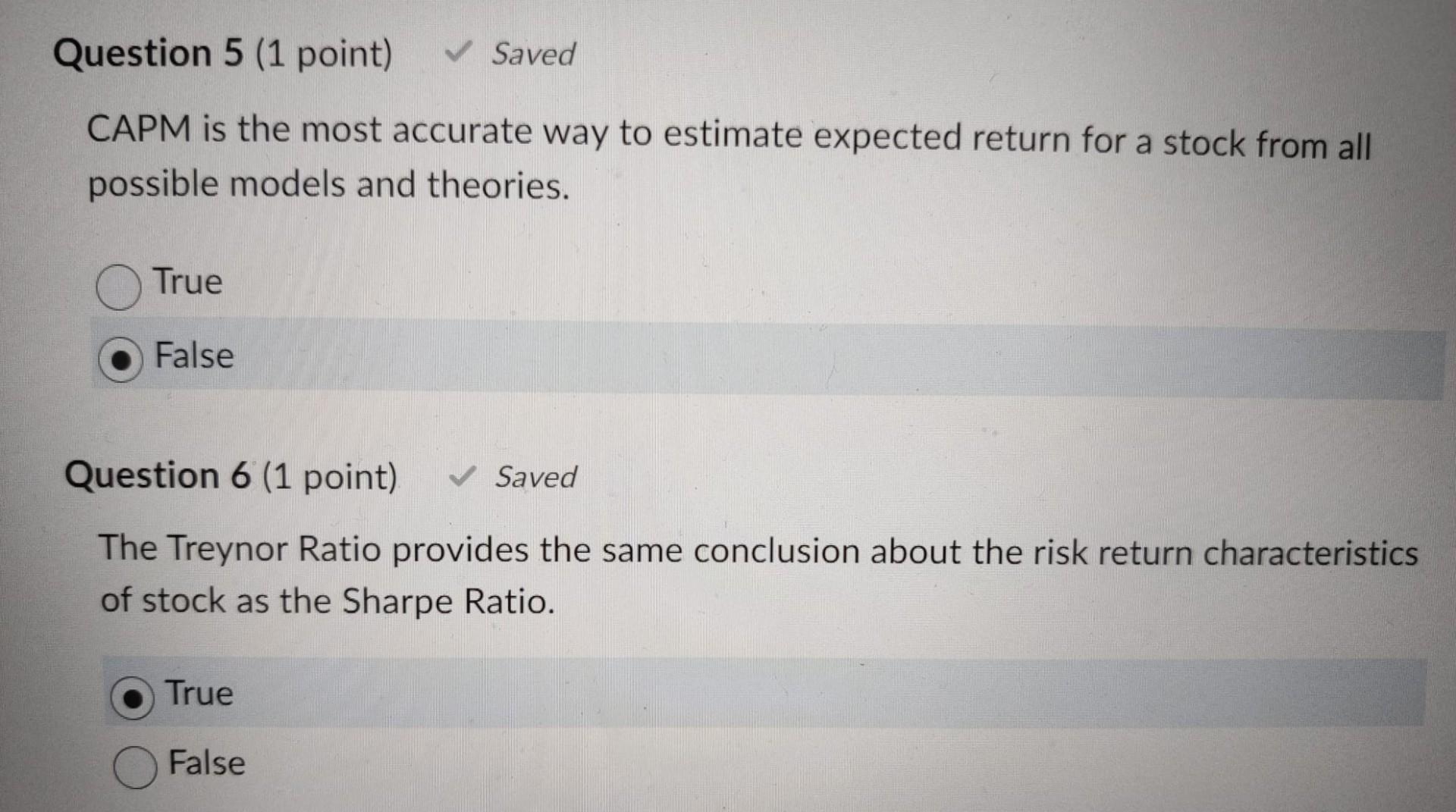

A portfolio with multiple components has an overall beta: Equal to its weighted average beta. Equal to its Beta and portfolio standard deviation. Equal to its systematic and non-systematic risk. Question 8 (1 point) Saved CAPM assumes: Assets can eliminate systematic risk. Assets are only stocks. Investors can lend and borrow at the risk free rate. Investors cannot short sell. CAPM is the most accurate way to estimate expected return for a stock from all possible models and theories. True False Question 6 (1 point) Saved The Treynor Ratio provides the same conclusion about the risk return characteristics of stock as the Sharpe Ratio. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts