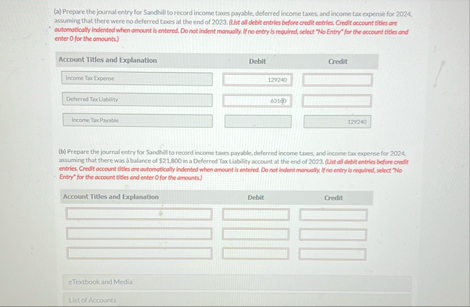

Question: ( a ) Prepare the journal entry for Sandiil to record income taxes payable, deferred income taves, and income tax openee for 2 0 2

a Prepare the journal entry for Sandiil to record income taxes payable, deferred income taves, and income tax openee for assuming that there were no deferred tawes at the end of Lht alf debit entries before oredt estries Orefit account bities art enter for the amounts.

Account Tities and Explanation

Debit

Credit

Ficome tix cxperset

Deserred Tax Lintility

Income Tax Pantie

b Prepare the journal entry for Sandhill to record income tasers payable, deferred income taves, and incone tax operse for ansurning that there was abolance of $ in a Deferred Tax Libbility acoount at the end of the all debte entrien before ondit Entry' for the account tides and enter Ofor the anounts

Account Titles and Explahation

Debit

Credit

eTrextbook and Media

thicthocounts

Your anwert is partolly correct.

At the end of andhill Company has $ of comulabe temporary differencis that will reult in reporting the following future tacible amounts.

table$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock