Question: A problem on actuarial science. Please try as hard as you can and submit your response within one hour. Even if the response is incomplete,

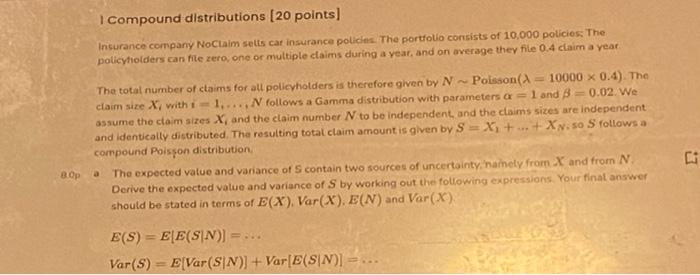

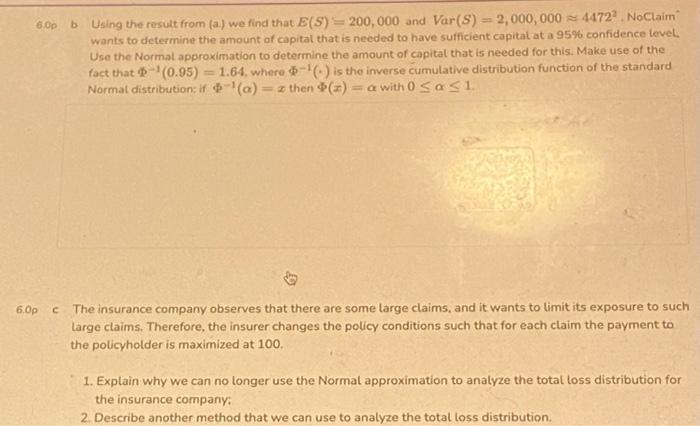

1 Compound distributions (20 points) Insurance company NoClaim selts car insurance policies. The portfolo consists of 10.000 policies. The policyholders can lite zero, one or multiple claims during a year, and on average they file 0.4 claim a year The total number of claims for all policyholders is therefore given by N Poisson = 10000 x 0.4). The claim size X, with 1..... N follows a Gamma distribution with parameters a = 1 and B 0.02. We assume the claim sizes X, and the claim number N to be independent and the claims sizes are independent and identically distributed. The resulting total claim amount is given by S = Xi+...+Xy.so follows a compound Poisson distribution The expected value and variance of contain two sources of uncertainty, nainely from X and from N Derive the expected value and variance of S by working out the following expressions. Your final answer should be stated in terms of E(X), Var(X). E(N) and Var(X). B. Op a E(S) = E[E(SIN)] = ... Var(S) = E[Var(SIN)] + Var[B(SIN)] 6.00 b Using the result from (a.) we find that E(S) = 200,000 and Var(s) = 2,000,000 = 44722 NoClaim wants to determine the amount of capital that is needed to have sufficient capital at a 95% confidence level. Use the Normal approximation to determine the amount of capital that is needed for this. Make use of the fact that -(0.95) = 1.64, where -'() is the inverse cumulative distribution function of the standard Normal distribution: if (a) = then (*) = a with 0 SaS1. 6.0p C The insurance company observes that there are some large claims, and it wants to limit its exposure to such Large claims. Therefore, the insurer changes the policy conditions such that for each claim the payment to the policyholder is maximized at 100. 1. Explain why we can no longer use the Normal approximation to analyze the total loss distribution for the insurance company: 2. Describe another method that we can use to analyze the total loss distribution 1 Compound distributions (20 points) Insurance company NoClaim selts car insurance policies. The portfolo consists of 10.000 policies. The policyholders can lite zero, one or multiple claims during a year, and on average they file 0.4 claim a year The total number of claims for all policyholders is therefore given by N Poisson = 10000 x 0.4). The claim size X, with 1..... N follows a Gamma distribution with parameters a = 1 and B 0.02. We assume the claim sizes X, and the claim number N to be independent and the claims sizes are independent and identically distributed. The resulting total claim amount is given by S = Xi+...+Xy.so follows a compound Poisson distribution The expected value and variance of contain two sources of uncertainty, nainely from X and from N Derive the expected value and variance of S by working out the following expressions. Your final answer should be stated in terms of E(X), Var(X). E(N) and Var(X). B. Op a E(S) = E[E(SIN)] = ... Var(S) = E[Var(SIN)] + Var[B(SIN)] 6.00 b Using the result from (a.) we find that E(S) = 200,000 and Var(s) = 2,000,000 = 44722 NoClaim wants to determine the amount of capital that is needed to have sufficient capital at a 95% confidence level. Use the Normal approximation to determine the amount of capital that is needed for this. Make use of the fact that -(0.95) = 1.64, where -'() is the inverse cumulative distribution function of the standard Normal distribution: if (a) = then (*) = a with 0 SaS1. 6.0p C The insurance company observes that there are some large claims, and it wants to limit its exposure to such Large claims. Therefore, the insurer changes the policy conditions such that for each claim the payment to the policyholder is maximized at 100. 1. Explain why we can no longer use the Normal approximation to analyze the total loss distribution for the insurance company: 2. Describe another method that we can use to analyze the total loss distribution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts