Question: A production project will generate an expected operating cash flow of $300,000 per year for 5 years (years 1 5). Undertaking the project will require

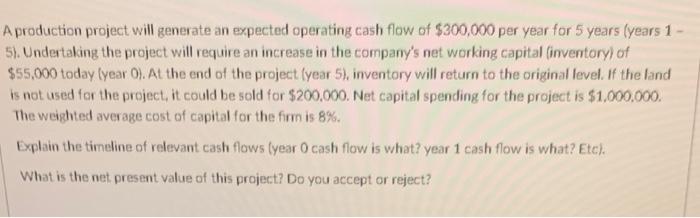

A production project will generate an expected operating cash flow of $300,000 per year for 5 years (years 1 5). Undertaking the project will require an increase in the company's net working capital (inventory) of $55,000 today (year 0). At the end of the project (year 5), inventory will return to the original level. If the land is not used for the project, it could be sold for $200,000. Net capital spending for the project is $1,000,000. The weighted average cost of capital for the firm is 8%. Explain the timeline of relevant cash flows (year 0 cash flow is what? year 1 cash flow is what? Etc). What is the net present value of this project? Do you accept or reject? A production project will generate an expected operating cash flow of $300,000 per year for 5 years (years 1 5). Undertaking the project will require an increase in the company's net working capital (inventory) of $55,000 today (year 0). At the end of the project (year 5), inventory will return to the original level. If the land is not used for the project, it could be sold for $200,000. Net capital spending for the project is $1,000,000. The weighted average cost of capital for the firm is 8%. Explain the timeline of relevant cash flows (year 0 cash flow is what? year 1 cash flow is what? Etc). What is the net present value of this project? Do you accept or reject

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts