Question: A project costs $150 million up front and is expected to return $70m in year 1, $60m in year 2, and $50m in year 3.

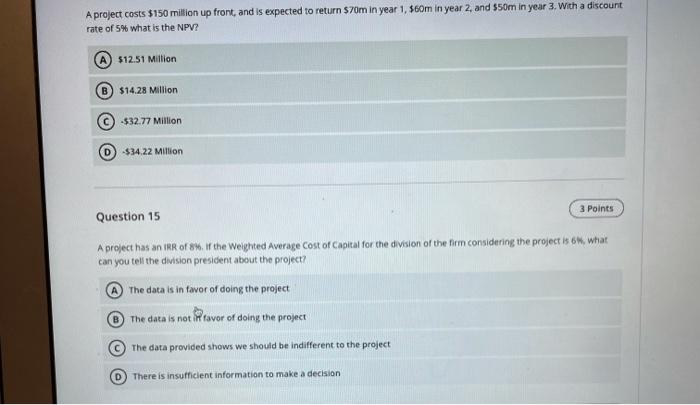

A project costs $150 million up front and is expected to return $70m in year 1, $60m in year 2, and $50m in year 3. With a discount rate of 5% what is the NPV? A $12.51 Million B) $14.28 Million -$32.77 Million -$34.22 Million 3 Points Question 15 A project has an IRR of 8%, if the weighted Average Cost of Capital for the division of the firm considering the project is ok, what can you tell the division president about the project? The data is in favor of doing the project The data is not favor of doing the project C The data provided shows we should be indifferent to the project D) There is insufficient information to make a decision

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock