Question: A project requires a $ 9 0 0 , 0 0 0 investment and management has estimated it will have an internal rate of return

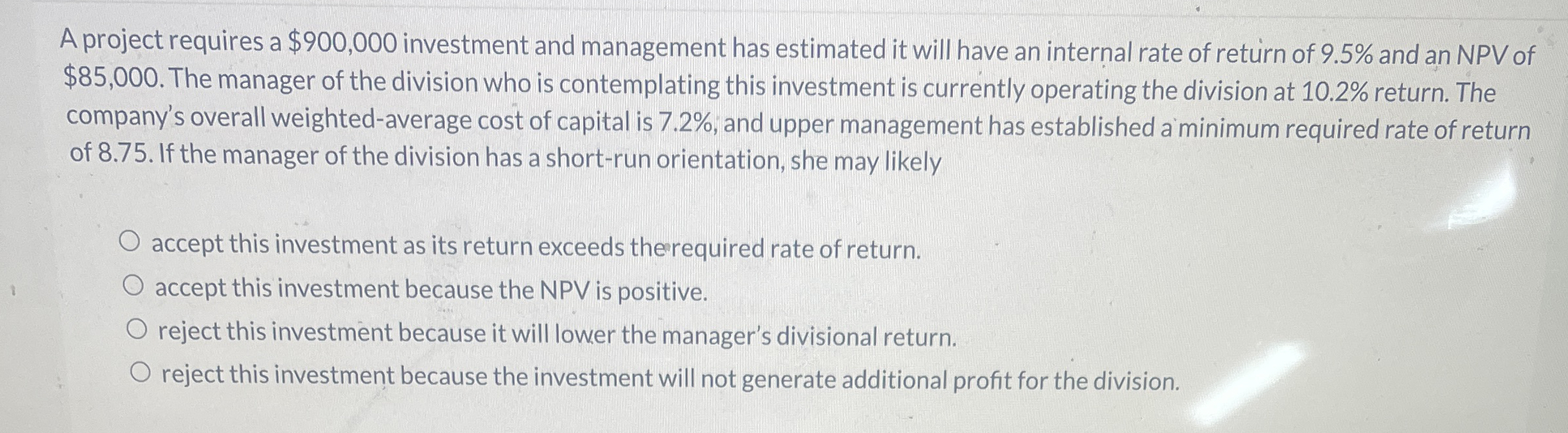

A project requires a $ investment and management has estimated it will have an internal rate of return of and an NPV of $ The manager of the division who is contemplating this investment is currently operating the division at return. The company's overall weightedaverage cost of capital is and upper management has established a minimum required rate of return of If the manager of the division has a shortrun orientation, she may likely

accept this investment as its return exceeds the required rate of return.

accept this investment because the NPV is positive.

reject this investment because it will lower the manager's divisional return.

reject this investment because the investment will not generate additional profit for the division.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock