Question: a. Purchasing automated assembly equipment, which should reduce direct labor costs by $4 per unit and increase variable overhead costs by $1 per unit and

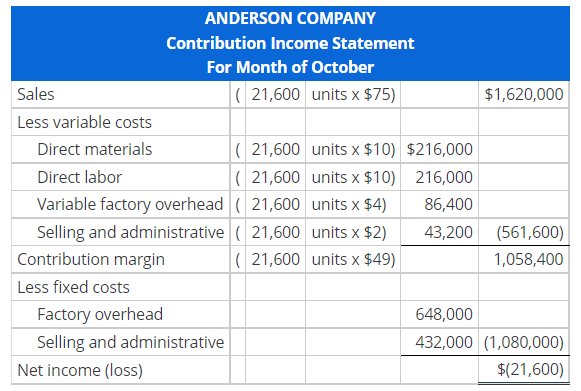

a. Purchasing automated assembly equipment, which should reduce direct labor costs by $4 per unit and increase variable overhead costs by $1 per unit and fixed factory overhead by $21,600 per month. b. Reducing the selling price by $5 per unit. This should increase the monthly sales by 5,400 units. At this higher volume, additional equipment and salaried personnel would be required. This will increase fixed factory overhead by $7,200 per month and fixed selling and administrative costs by $3,240 per month. c. Buying rather than manufacturing a component of Andersons final product. This will increase direct materials costs by $5 per unit. However, direct labor will decline $3 per unit, variable factory overhead will decline $1 per unit, and fixed factory overhead will decline $45,000 per month. d. Increasing the unit selling price by $5 per unit. This action should result in a 3,600 unit decrease in monthly sales. e. Combining alternatives (a) and (d).

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts