Question: A second version of the Markowitz portfolio model maximizes expected return subject to a constraint that the variance of the portfolio must be less than

A second version of the Markowitz portfolio model maximizes expected return subject to a constraint that the variance of the portfolio must be less than or equal to some specified amount. Consider the Hauck Financial Service data. We list the data again below along with the return of the S&P 500 Index. Hauck would like to create a portfolio using the funds listed, so that the resulting portfolio matches the return of the S&P 500 index as closely as possible.

| Mutual Fund | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Foreign Stock | 10.06 | 13.12 | 13.47 | 45.42 | -21.93 |

| Intermediate-Term Bond | 17.64 | 3.25 | 7.51 | -1.33 | 7.36 |

| Large-Cap Growth | 32.41 | 18.71 | 33.28 | 41.46 | -23.26 |

| Large-Cap Value | 32.36 | 20.61 | 12.93 | 7.06 | -5.37 |

| Small-Cap Growth | 33.44 | 19.4 | 3.85 | 58.68 | -9.02 |

| Small-Cap Value | 24.56 | 25.32 | -6.7 | 5.43 | 17.31 |

| S&P 500 Return | 25 | 20 | 8 | 30 | -10 |

| (a) | Develop an optimization model that will give the fraction of the portfolio to invest in each of the funds so that the return of the resulting portfolio matches as closely as possible the return of the S&P 500 Index. Hint: Minimize the sum of the squared deviations between the portfolio's return and the S&P 500 Index return for each year in the data set. | ||||||||||||||||

|

| (a) | |

|

|

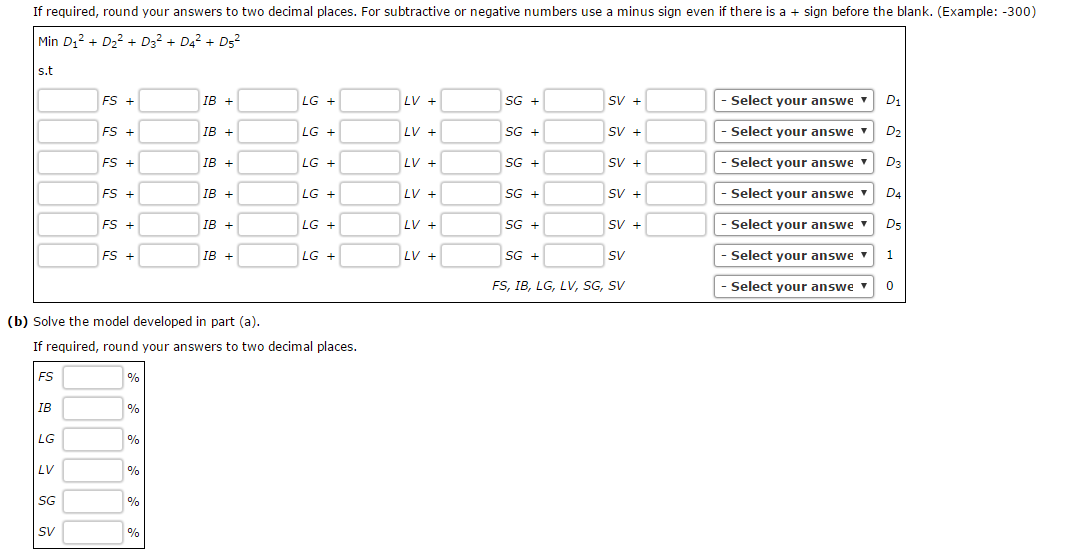

If required, round your answers to two decimal places. For subtractive or negative numbers use a minus sign even if there is a sign before the blank. (Example: -300) Min D D D D42 D52 2 3 s.t SG Select your answe D1 IB LG LV SV LV SG Select your answe D2 IB LG SV SG Select your answe D3 IB LG LV SV LV SG Select your answe D4 IB LG SV SG Select your answe D5 IB LG LV SV LV SG Select your answe 1 IB LG SV FS, IB, LG, LV, SG, SV Select your answe 0 (b) Solve the model developed in part (a) If required, round your answers to two decimal places. FS IB LG LV SG SV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts