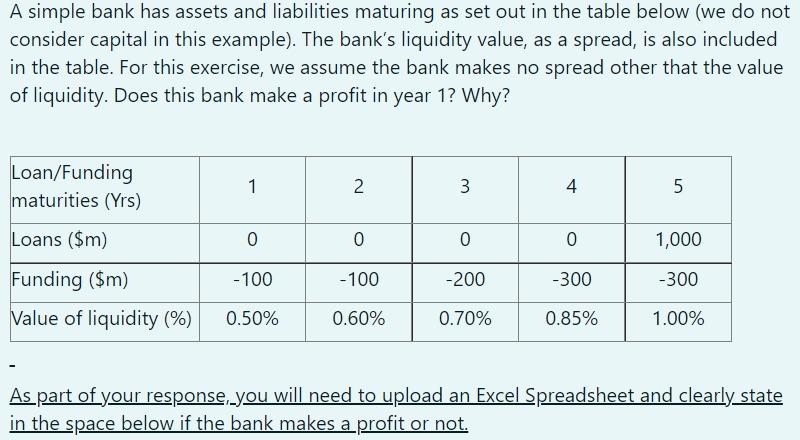

Question: A simple bank has assets and liabilities maturing as set out in the table below (we do not consider capital in this example). The bank's

A simple bank has assets and liabilities maturing as set out in the table below (we do not consider capital in this example). The bank's liquidity value, as a spread, is also included in the table. For this exercise, we assume the bank makes no spread other that the value of liquidity. Does this bank make a profit in year 1? Why? Loan/Funding maturities (Yrs) 1 2 3 3 4 5 Loans ($m) 0 0 0 0 1,000 -100 - 100 -200 -300 -300 Funding ($m) Value of liquidity (%) 0.50% 0.60% 0.70% 0.85% 1.00% As part of your response, you will need to upload an Excel Spreadsheet and clearly state in the space below if the bank makes a profit or not. A simple bank has assets and liabilities maturing as set out in the table below (we do not consider capital in this example). The bank's liquidity value, as a spread, is also included in the table. For this exercise, we assume the bank makes no spread other that the value of liquidity. Does this bank make a profit in year 1? Why? Loan/Funding maturities (Yrs) 1 2 3 3 4 5 Loans ($m) 0 0 0 0 1,000 -100 - 100 -200 -300 -300 Funding ($m) Value of liquidity (%) 0.50% 0.60% 0.70% 0.85% 1.00% As part of your response, you will need to upload an Excel Spreadsheet and clearly state in the space below if the bank makes a profit or not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts